Chapter 15 Intermediate Regression

15.1 Parallel Slopes

The case when there is one numeric explanatory variable and one categorical explanatory variable is sometimes called a “parallel slopes” linear regression due to the shape of the predictions.

15.1.1 Parallel slopes linear regression

Here, you’ll revisit the Taiwan real estate dataset.

library(tidyverse)

library(fst)

taiwan_real_estate <- read_fst("data/taiwan_real_estate2.fst")

glimpse(taiwan_real_estate)## Rows: 414

## Columns: 4

## $ dist_to_mrt_m <dbl> 84.9, 306.6, 562.0, 562.0, 390.6, 2175.0, 623.5, 287.6…

## $ n_convenience <dbl> 10, 9, 5, 5, 5, 3, 7, 6, 1, 3, 1, 9, 5, 4, 4, 2, 6, 1,…

## $ house_age_years <fct> 30 to 45, 15 to 30, 0 to 15, 0 to 15, 0 to 15, 0 to 15…

## $ price_twd_msq <dbl> 11.47, 12.77, 14.31, 16.58, 13.04, 9.71, 12.19, 14.13,…15.1.1.1 Fitting & Interpreting model

To combine multiple explanatory variables in the regression formula, separate them with a +.

# Fit a linear regr'n of price_twd_msq vs. n_convenience

mdl_price_vs_conv <- lm(price_twd_msq ~ n_convenience, taiwan_real_estate)

# See the result

mdl_price_vs_conv##

## Call:

## lm(formula = price_twd_msq ~ n_convenience, data = taiwan_real_estate)

##

## Coefficients:

## (Intercept) n_convenience

## 8.224 0.798# Fit a linear regr'n of price_twd_msq vs. house_age_years, no intercept

mdl_price_vs_age <- lm(price_twd_msq ~ house_age_years + 0, taiwan_real_estate)

# See the result

mdl_price_vs_age##

## Call:

## lm(formula = price_twd_msq ~ house_age_years + 0, data = taiwan_real_estate)

##

## Coefficients:

## house_age_years0 to 15 house_age_years15 to 30 house_age_years30 to 45

## 12.64 9.88 11.39# Fit a linear regr'n of price_twd_msq vs. n_convenience plus house_age_years, no intercept

mdl_price_vs_both <- lm(price_twd_msq ~ n_convenience + house_age_years + 0, taiwan_real_estate)

# See the result

mdl_price_vs_both##

## Call:

## lm(formula = price_twd_msq ~ n_convenience + house_age_years +

## 0, data = taiwan_real_estate)

##

## Coefficients:

## n_convenience house_age_years0 to 15 house_age_years15 to 30

## 0.791 9.413 7.085

## house_age_years30 to 45

## 7.511Interpreting parallel slopes coefficients

The mdl_price_vs_both has one slope coefficient, and three intercept coefficients (one for each possible value of the categorical explanatory variable).

What is the meaning of the

n_conveniencecoefficient?- For each additional nearby convenience store, the expected house price, in TWD per square meter, increases by

0.79.

- For each additional nearby convenience store, the expected house price, in TWD per square meter, increases by

What is the meaning of the “0 to 15 years” coefficient?

- For a house aged 0 to 15 years with zero nearby convenience stores, the expected house price is

9.41TWD per square meter.

- For a house aged 0 to 15 years with zero nearby convenience stores, the expected house price is

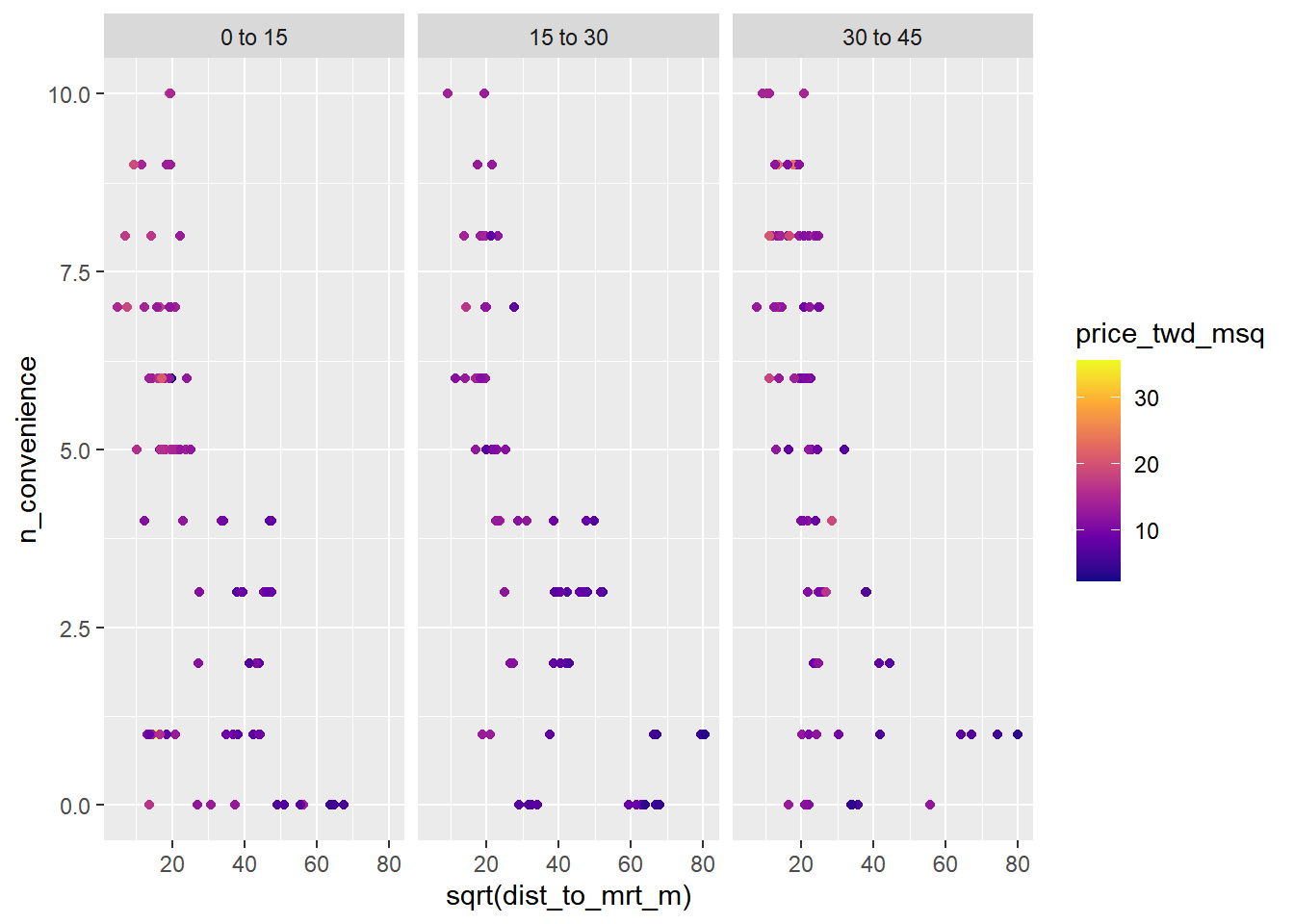

15.1.1.2 Visualizing each IV

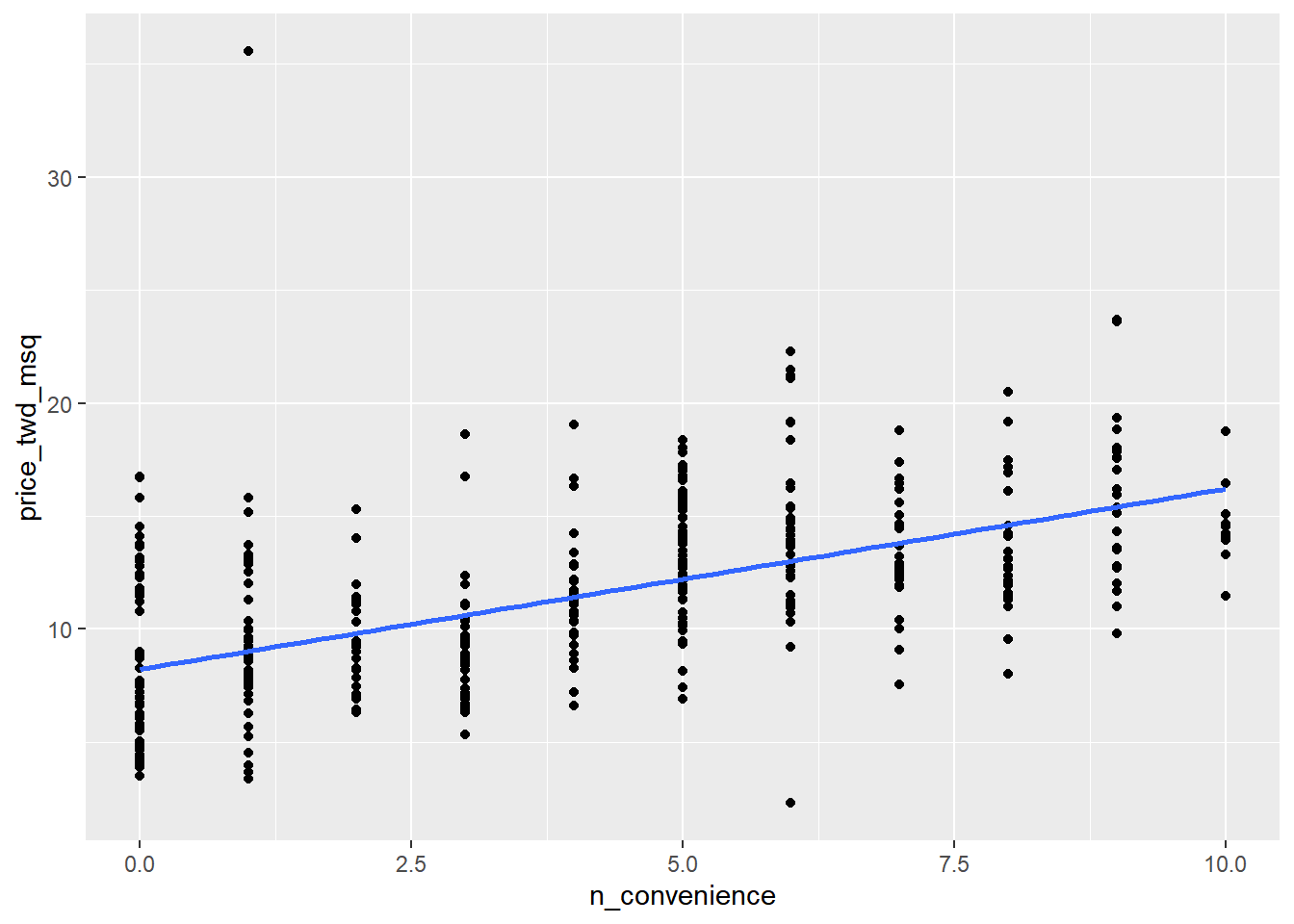

To visualize the relationship between a numeric explanatory variable and the numeric response, you can draw a scatter plot with a linear trend line.

With a single numeric explanatory variable, the predictions form a single straight line.

# Using taiwan_real_estate, plot price_twd_msq vs. n_convenience

ggplot(taiwan_real_estate, aes(n_convenience, price_twd_msq)) +

# Add a point layer

geom_point() +

# Add a smooth trend line using linear regr'n, no ribbon

geom_smooth(method = "lm", se = FALSE)## `geom_smooth()` using formula = 'y ~ x'

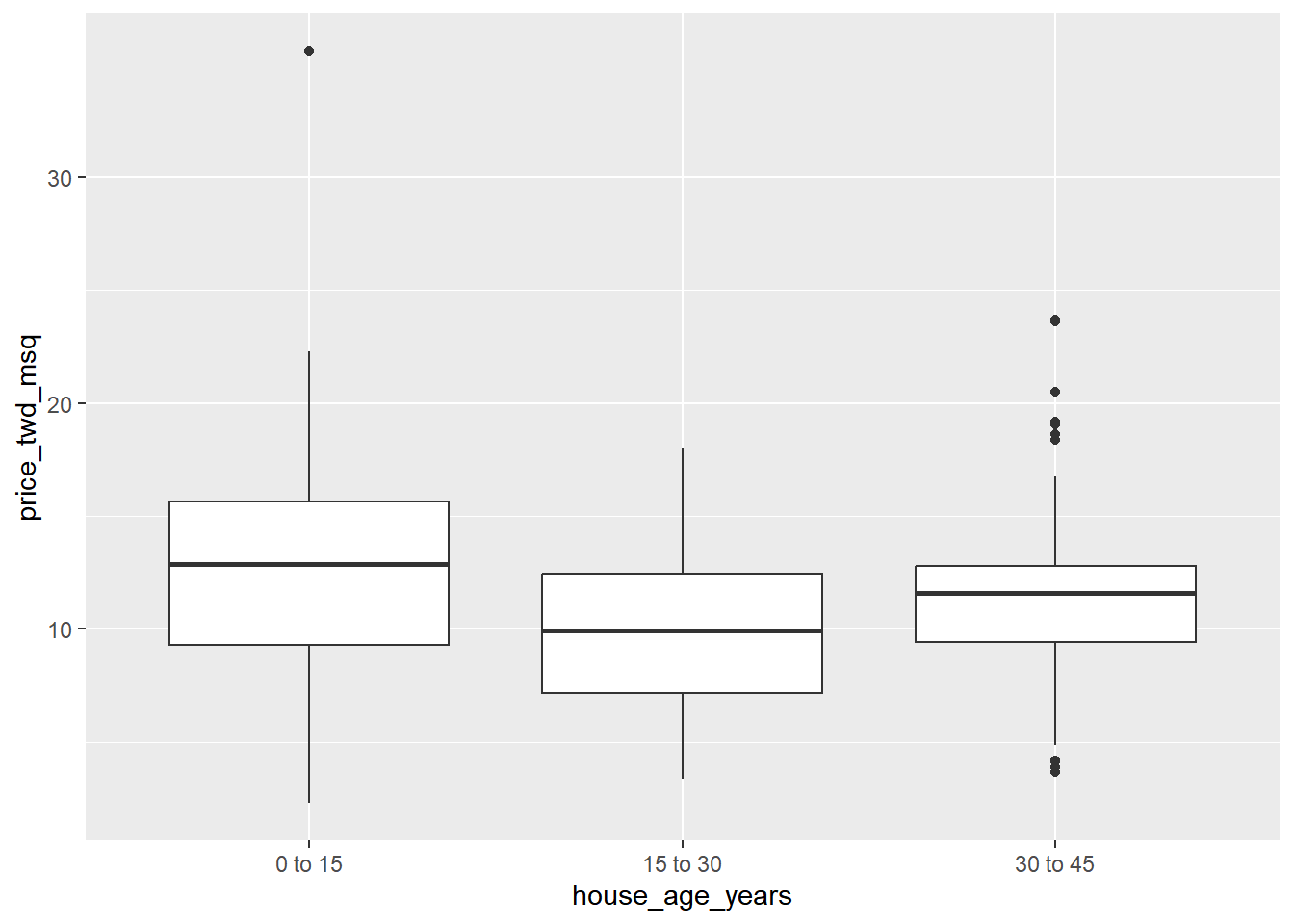

To visualize the relationship between a categorical explanatory variable and the numeric response, you can draw a box plot.

With a single categorical explanatory variable, the predictions are the means for each category.

# Using taiwan_real_estate, plot price_twd_msq vs. house_age_years

ggplot(taiwan_real_estate, aes(house_age_years, price_twd_msq)) +

# Add a box plot layer

geom_boxplot()

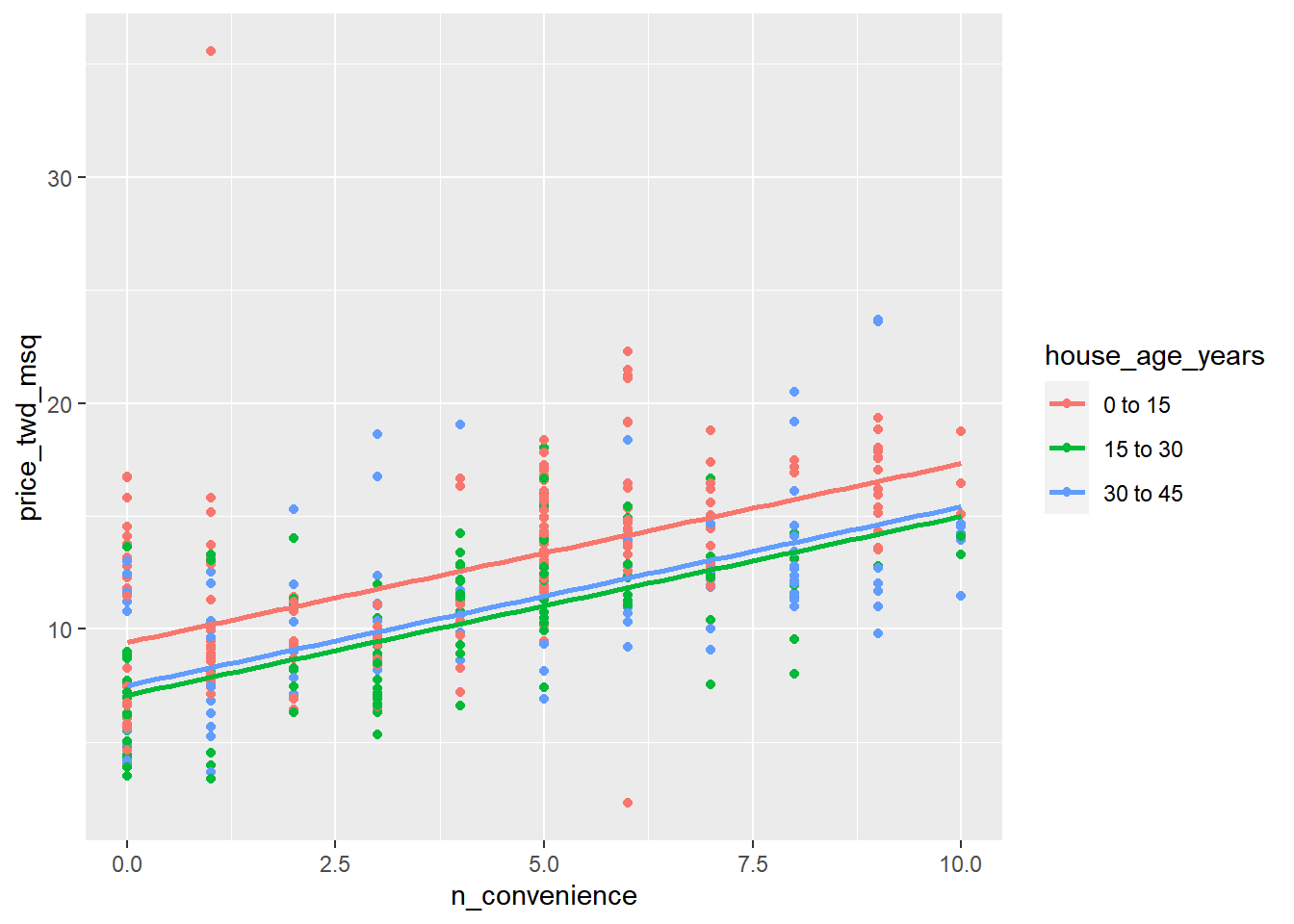

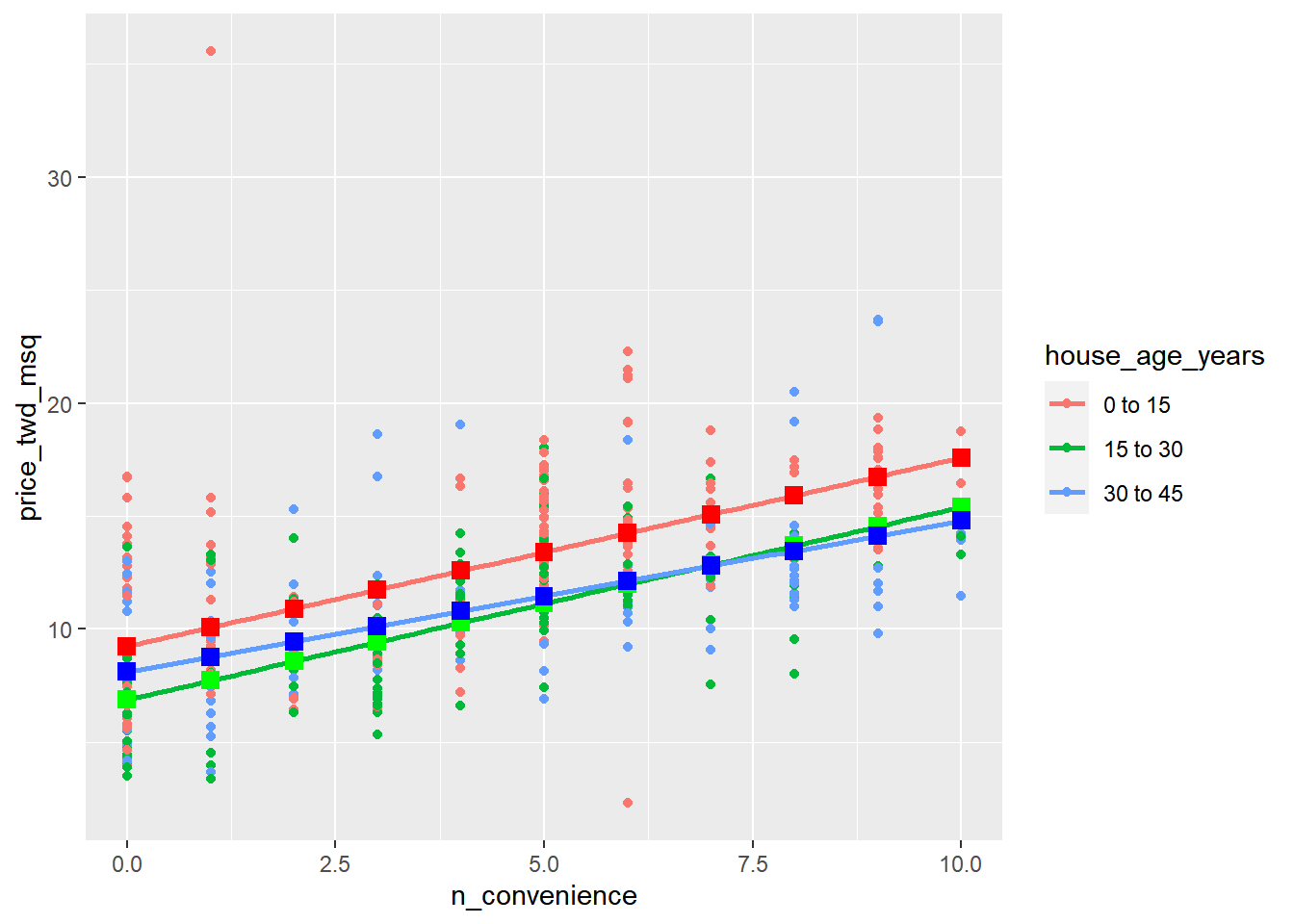

15.1.1.3 Visualizing parallel slopes

The moderndive package includes an extra geom, geom_parallel_slopes() to show the predictions.

# Using taiwan_real_estate, plot price_twd_msq vs. n_convenience colored by house_age_years

ggplot(taiwan_real_estate, aes(n_convenience, price_twd_msq, color = house_age_years)) +

# Add a point layer

geom_point() +

# Add parallel slopes, no ribbon

moderndive::geom_parallel_slopes(se = FALSE)

The “parallel slope” model name comes from the fact that the prediction for each category is a slope, and all those slopes are parallel.

15.1.2 Predicting parallel slopes

15.1.2.1 Predicting parallel slopes model

Just as with the case of a single explanatory variable, the workflow has two steps: create a data frame of explanatory variables, then add a column of predictions.

Make a grid (expand_grid()) of explanatory data, formed from combinations of the following variables.

# Make a grid of explanatory data

explanatory_data <- expand_grid(

# Set n_convenience to zero to ten

n_convenience = 0:10,

# Set house_age_years to the unique values of that variable

house_age_years = unique(taiwan_real_estate$house_age_years)

)

# See the result

explanatory_data## # A tibble: 33 × 2

## n_convenience house_age_years

## <int> <fct>

## 1 0 30 to 45

## 2 0 15 to 30

## 3 0 0 to 15

## 4 1 30 to 45

## 5 1 15 to 30

## 6 1 0 to 15

## 7 2 30 to 45

## 8 2 15 to 30

## 9 2 0 to 15

## 10 3 30 to 45

## # ℹ 23 more rows# Add predictions to the data frame

prediction_data <- explanatory_data %>%

mutate(price_twd_msq = predict(mdl_price_vs_both, explanatory_data))

# See the result

prediction_data## # A tibble: 33 × 3

## n_convenience house_age_years price_twd_msq

## <int> <fct> <dbl>

## 1 0 30 to 45 7.51

## 2 0 15 to 30 7.09

## 3 0 0 to 15 9.41

## 4 1 30 to 45 8.30

## 5 1 15 to 30 7.88

## 6 1 0 to 15 10.2

## 7 2 30 to 45 9.09

## 8 2 15 to 30 8.67

## 9 2 0 to 15 11.0

## 10 3 30 to 45 9.89

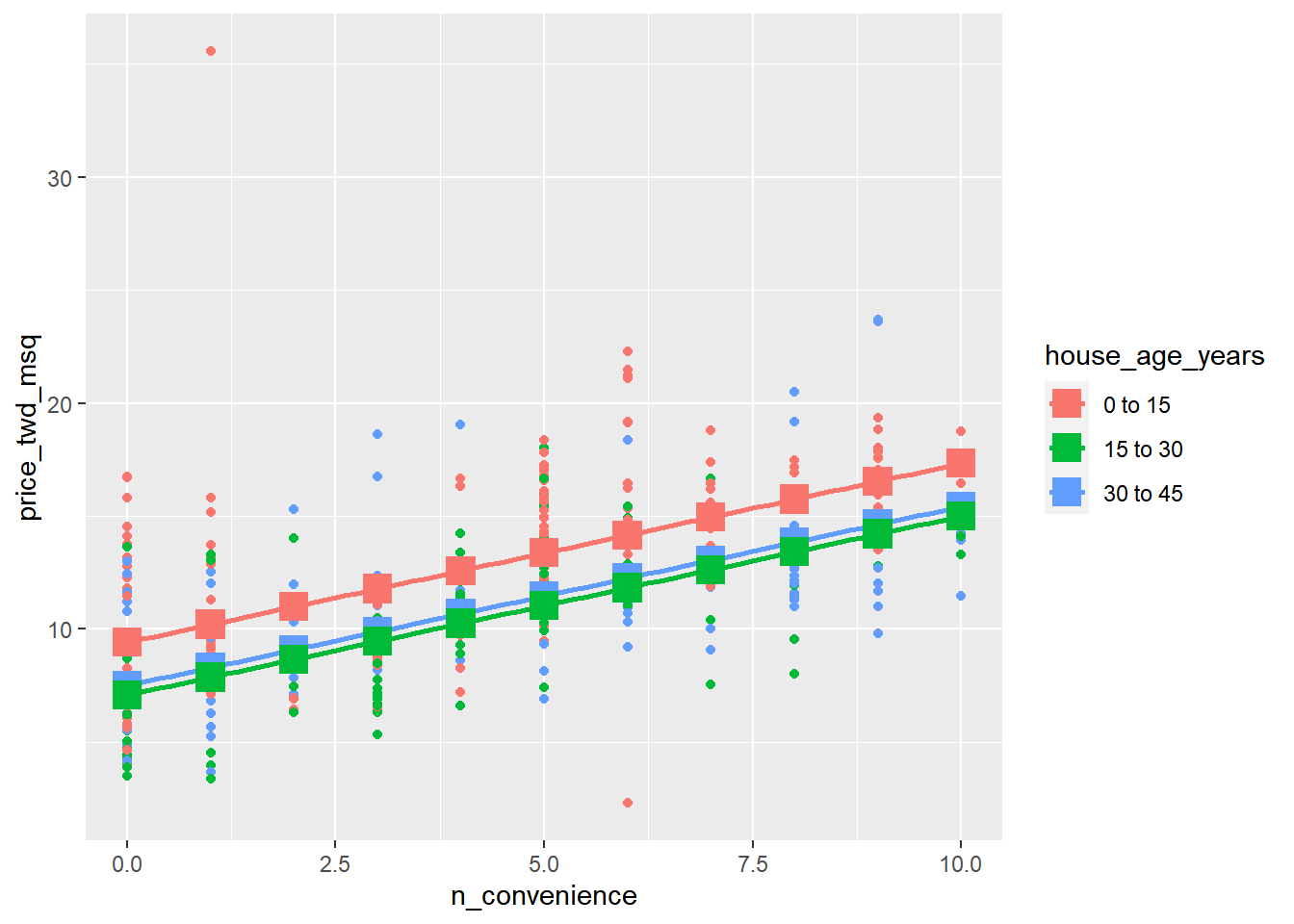

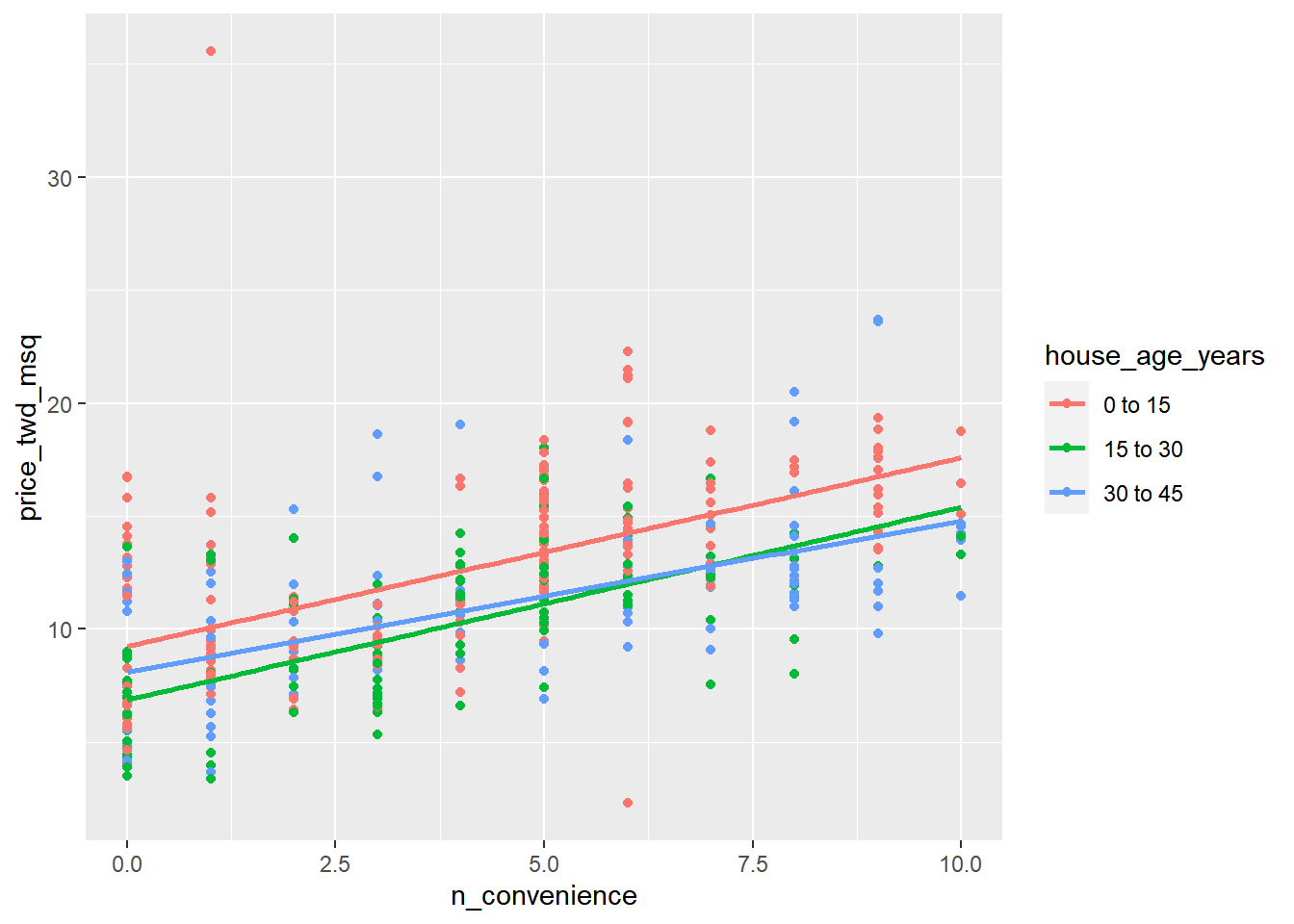

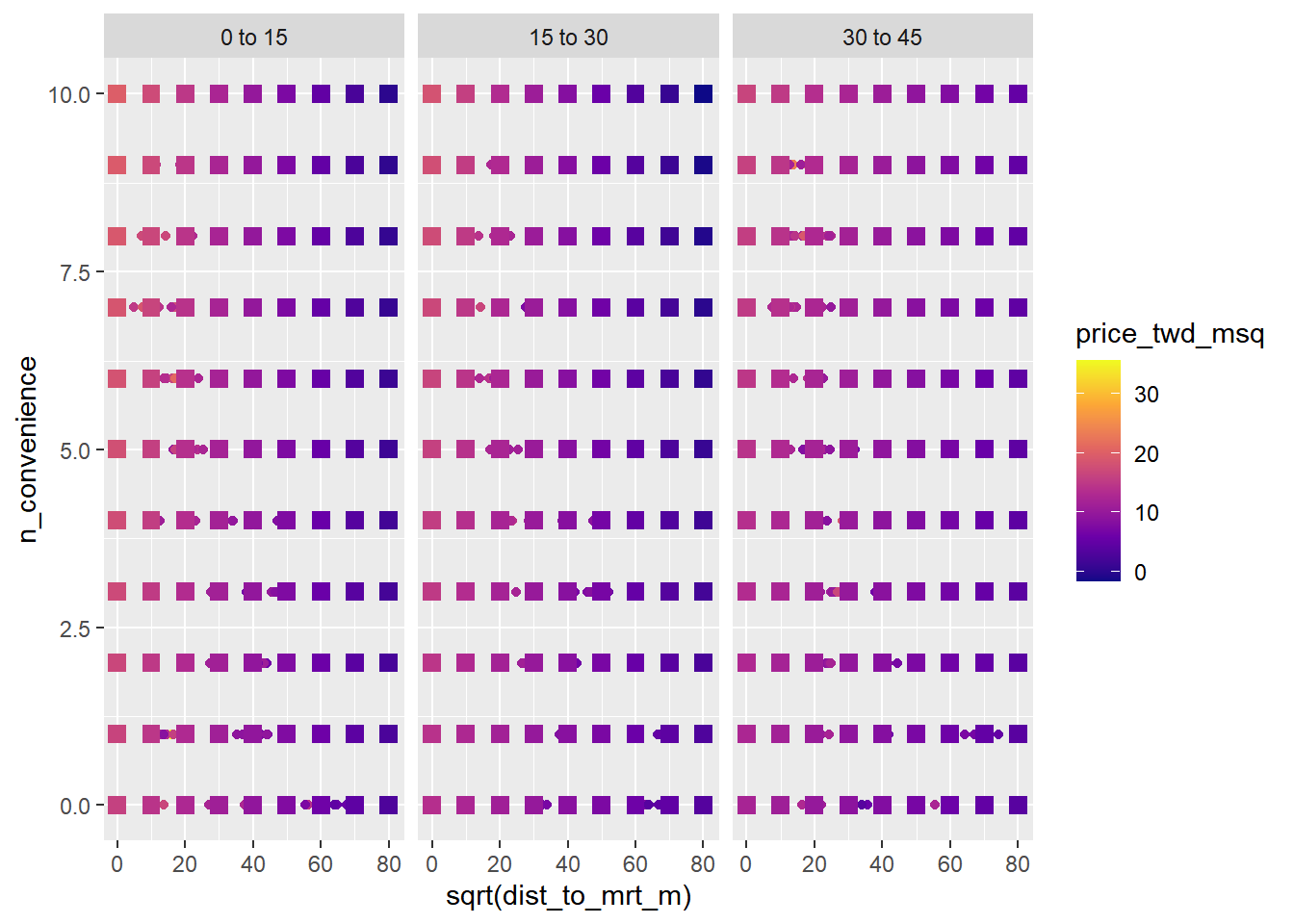

## # ℹ 23 more rowsTo make sure you’ve got the right answer, you can add your predictions to the ggplot with the geom_parallel_slopes() lines.

# Update the plot to add a point layer of predictions

taiwan_real_estate %>%

ggplot(aes(n_convenience, price_twd_msq, color = house_age_years)) +

geom_point() +

moderndive::geom_parallel_slopes(se = FALSE) +

# Add points using prediction_data, with size 5 and shape 15

geom_point(data = prediction_data, size = 5, shape = 15)

15.1.2.2 Manually calculating predictions

As with simple linear regression, you can manually calculate the predictions from the model coefficients.

The only change for the parallel slopes case is that the intercept is different for each category of the categorical explanatory variable. That means you need to consider the case when (case_when or if_else) each each category occurs separately.

dataframe %>%

mutate(

case_when(

condition_1 ~ value_1,

condition_2 ~ value_2,

# ...

condition_n ~ value_n

)

)Assign each of the elements of coeffs to the appropriate variable.

# Get the coefficients from mdl_price_vs_both

coeffs <- coefficients(mdl_price_vs_both)

# Extract the slope coefficient

slope <- coeffs[1]

# Extract the intercept coefficient for 0 to 15

intercept_0_15 <- coeffs[2]

# Extract the intercept coefficient for 15 to 30

intercept_15_30 <- coeffs[3]

# Extract the intercept coefficient for 30 to 45

intercept_30_45 <- coeffs[4]

# See elements

list(coeffs = coeffs, slope = slope, intercept_0_15 = intercept_0_15, intercept_15_30 = intercept_15_30, intercept_30_45 = intercept_30_45)## $coeffs

## n_convenience house_age_years0 to 15 house_age_years15 to 30

## 0.791 9.413 7.085

## house_age_years30 to 45

## 7.511

##

## $slope

## n_convenience

## 0.791

##

## $intercept_0_15

## house_age_years0 to 15

## 9.41

##

## $intercept_15_30

## house_age_years15 to 30

## 7.09

##

## $intercept_30_45

## house_age_years30 to 45

## 7.51prediction_data <- explanatory_data %>%

mutate(

# Consider the 3 cases to choose the intercept

intercept = case_when(

house_age_years == "0 to 15" ~ intercept_0_15,

house_age_years == "15 to 30" ~ intercept_15_30,

house_age_years == "30 to 45" ~ intercept_30_45

),

# Manually calculate the predictions

price_twd_msq = intercept + slope * n_convenience

)

# See the results

prediction_data## # A tibble: 33 × 4

## n_convenience house_age_years intercept price_twd_msq

## <int> <fct> <dbl> <dbl>

## 1 0 30 to 45 7.51 7.51

## 2 0 15 to 30 7.09 7.09

## 3 0 0 to 15 9.41 9.41

## 4 1 30 to 45 7.51 8.30

## 5 1 15 to 30 7.09 7.88

## 6 1 0 to 15 9.41 10.2

## 7 2 30 to 45 7.51 9.09

## 8 2 15 to 30 7.09 8.67

## 9 2 0 to 15 9.41 11.0

## 10 3 30 to 45 7.51 9.89

## # ℹ 23 more rows15.1.3 Assessing model performance

Model performance metrics

Coefficient of determination (R-squared)

How well the linear regression line fits the observed values.

Larger is better.

Residual standard error (RSE)

The typical size of the residuals.

Smaller is better.

Adjusted coefficient of determination (Adjusted R-squared)

More explanatory variables increases R². Too many explanatory variables causes overfitting.

Adjusted coefficient of determination penalizes more explanatory variables.

15.1.3.1 Compare adjusted R²

Here you’ll compare the coefficient of determination for the three Taiwan house price models, to see which gives the best result.

library(broom)

mdl_price_vs_conv %>%

# Get the model-level coefficients

glance() %>%

# Select the coeffs of determination

select(r.squared, adj.r.squared)## # A tibble: 1 × 2

## r.squared adj.r.squared

## <dbl> <dbl>

## 1 0.326 0.324# Get the coeffs of determination for mdl_price_vs_age

mdl_price_vs_age %>%

glance() %>%

select(r.squared, adj.r.squared)## # A tibble: 1 × 2

## r.squared adj.r.squared

## <dbl> <dbl>

## 1 0.896 0.895# Get the coeffs of determination for mdl_price_vs_both

mdl_price_vs_both %>%

glance() %>%

select(r.squared, adj.r.squared)## # A tibble: 1 × 2

## r.squared adj.r.squared

## <dbl> <dbl>

## 1 0.931 0.931When both explanatory variables are included in the model, the adjusted coefficient of determination is higher, resulting in a better fit.

15.1.3.2 Compare RSE

mdl_price_vs_conv %>%

# Get the model-level coefficients

glance() %>%

# Pull out the RSE

pull(sigma)## [1] 3.38# Get the RSE for mdl_price_vs_age

mdl_price_vs_age %>%

glance() %>%

pull(sigma)## [1] 3.95# Get the RSE for mdl_price_vs_both

mdl_price_vs_both %>%

glance() %>%

pull(sigma)## [1] 3.21By including both explanatory variables in the model, a lower RSE was achieved, indicating a smaller difference between the predicted responses and the actual responses.

15.2 Interactions

15.2.1 Models for each category

15.2.1.1 One model per category

The model you ran on the whole dataset fits some parts of the data better than others. It’s worth taking a look at what happens when you run a linear model on different parts of the dataset separately, to see if each model agrees or disagrees with the others.

# Filter for rows where house age is 0 to 15 years

taiwan_0_to_15 <- taiwan_real_estate %>% filter(house_age_years == "0 to 15")

# Filter for rows where house age is 15 to 30 years

taiwan_15_to_30 <- taiwan_real_estate %>% filter(house_age_years == "15 to 30")

# Filter for rows where house age is 30 to 45 years

taiwan_30_to_45 <- taiwan_real_estate %>% filter(house_age_years == "30 to 45")

# Model price vs. no. convenience stores using 0 to 15 data

mdl_0_to_15 <- lm(price_twd_msq ~ n_convenience, taiwan_0_to_15)

# Model price vs. no. convenience stores using 15 to 30 data

mdl_15_to_30 <- lm(price_twd_msq ~ n_convenience, taiwan_15_to_30)

# Model price vs. no. convenience stores using 30 to 45 data

mdl_30_to_45 <- lm(price_twd_msq ~ n_convenience, taiwan_30_to_45)

# See the results

mdl_0_to_15##

## Call:

## lm(formula = price_twd_msq ~ n_convenience, data = taiwan_0_to_15)

##

## Coefficients:

## (Intercept) n_convenience

## 9.242 0.834mdl_15_to_30##

## Call:

## lm(formula = price_twd_msq ~ n_convenience, data = taiwan_15_to_30)

##

## Coefficients:

## (Intercept) n_convenience

## 6.872 0.852mdl_30_to_45##

## Call:

## lm(formula = price_twd_msq ~ n_convenience, data = taiwan_30_to_45)

##

## Coefficients:

## (Intercept) n_convenience

## 8.113 0.66915.2.1.2 Predicting multiple models

In order to see what each of the models for individual categories are doing, it’s helpful to make predictions from them.

Remember that you only have a single explanatory variable in these models, so expand_grid() isn’t needed.

# Add column of predictions using "0 to 15" model and explanatory data

prediction_data_0_to_15 <- explanatory_data %>%

mutate(price_twd_msq = predict(mdl_0_to_15, explanatory_data))

# Same again, with "15 to 30"

prediction_data_15_to_30 <- explanatory_data %>%

mutate(price_twd_msq = predict(mdl_15_to_30, explanatory_data))

# Same again, with "30 to 45"

prediction_data_30_to_45 <- explanatory_data %>%

mutate(price_twd_msq = predict(mdl_30_to_45, explanatory_data))15.2.1.3 Visualizing multiple models

# Extend the plot to include prediction points

ggplot(taiwan_real_estate, aes(n_convenience, price_twd_msq,

color = house_age_years)) +

geom_point() +

geom_smooth(method = "lm", se = FALSE) +

# Add points using prediction_data_0_to_15, colored red, size 3, shape 15

geom_point(data = prediction_data_0_to_15, color = "red", size = 3, shape = 15) +

# Add points using prediction_data_15_to_30, colored green, size 3, shape 15

geom_point(data = prediction_data_15_to_30, color = "green", size = 3, shape = 15) +

# Add points using prediction_data_30_to_45, colored blue, size 3, shape 15

geom_point(data = prediction_data_30_to_45, color = "blue", size = 3, shape = 15)## `geom_smooth()` using formula = 'y ~ x'

It’s a good sign that our predictions match those of ggplot’s. Notice that the 30 to 45 year house age group has a much shallower slope compared to the other lines.

15.2.1.4 Assessing model performance

To test which approach is best—the whole dataset model or the models for each house age category—you need to calculate some metrics.

Here’s, you’ll compare the coefficient of determination and the residual standard error for each model.

mdl_all_ages <- lm(formula = price_twd_msq ~ n_convenience, data = taiwan_real_estate)

# Get the coeff. of determination for mdl_all_ages

mdl_all_ages %>%

glance() %>%

pull(r.squared)## [1] 0.326# Get the coeff. of determination for mdl_0_to_15

mdl_0_to_15 %>%

glance() %>%

pull(r.squared)## [1] 0.312# Get the coeff. of determination for mdl_15_to_30

mdl_15_to_30 %>%

glance() %>%

pull(r.squared)## [1] 0.442# Get the coeff. of determination for mdl_30_to_45

mdl_30_to_45 %>%

glance() %>%

pull(r.squared)## [1] 0.313# Get the RSE for mdl_all_age

mdl_all_ages %>%

glance() %>%

pull(sigma)## [1] 3.38# Get the RSE for mdl_0_to_15

mdl_0_to_15 %>%

glance() %>%

pull(sigma)## [1] 3.56# Get the RSE for mdl_15_to_30

mdl_15_to_30 %>%

glance() %>%

pull(sigma)## [1] 2.59# Get the RSE for mdl_30_to_45

mdl_30_to_45 %>%

glance() %>%

pull(sigma)## [1] 3.24It seems that both metrics for the 15 to 30 age group model are much better than those for the whole dataset model, but the models for the other two age groups are similar to the whole dataset model.

Thus using individual models will improve predictions for 15 to 30 age group.

15.2.2 One model with an interaction

What is an interaction?

Specifying interactions

No interactions

response ~ explntry1 + explntry2

With interactions (implicit)

response_var ~ explntry1 * explntry2

With interactions (explicit)

response ~ explntry1 + explntry2 + explntry1:explntry2

15.2.2.1 Specifying an interaction

Ideally, you’d have a single model that had all the predictive power of the individual models.

Defining this single model is achieved through adding interactions between explanatory variables.

Concise code that is quick to type and to read.

# Model price vs both with an interaction using "times" syntax

lm(price_twd_msq ~ n_convenience * house_age_years, taiwan_real_estate)##

## Call:

## lm(formula = price_twd_msq ~ n_convenience * house_age_years,

## data = taiwan_real_estate)

##

## Coefficients:

## (Intercept) n_convenience

## 9.2417 0.8336

## house_age_years15 to 30 house_age_years30 to 45

## -2.3698 -1.1286

## n_convenience:house_age_years15 to 30 n_convenience:house_age_years30 to 45

## 0.0183 -0.1649Explicit code that describes what you are doing in detail.

# Model price vs both with an interaction using "colon" syntax

lm(price_twd_msq ~ n_convenience + house_age_years + n_convenience: house_age_years, taiwan_real_estate)##

## Call:

## lm(formula = price_twd_msq ~ n_convenience + house_age_years +

## n_convenience:house_age_years, data = taiwan_real_estate)

##

## Coefficients:

## (Intercept) n_convenience

## 9.2417 0.8336

## house_age_years15 to 30 house_age_years30 to 45

## -2.3698 -1.1286

## n_convenience:house_age_years15 to 30 n_convenience:house_age_years30 to 45

## 0.0183 -0.164915.2.2.2 Understandable coeffs

The previous model with the interaction term returned coefficients that were a little tricky to interpret. In order clarify what the model is predicting, you can reformulate the model in a way that returns understandable coefficients.

For further clarity, you can compare the results to the models on the separate house age categories.

Fit a linear regression of price_twd_msq versus house_age_years plus an interaction between n_convenience and house_age_years, and no global intercept.

# Model price vs. house age plus an interaction, no intercept

mdl_readable_inter <- lm(price_twd_msq ~ house_age_years + house_age_years:n_convenience + 0, taiwan_real_estate)

# See the result

mdl_readable_inter##

## Call:

## lm(formula = price_twd_msq ~ house_age_years + house_age_years:n_convenience +

## 0, data = taiwan_real_estate)

##

## Coefficients:

## house_age_years0 to 15 house_age_years15 to 30

## 9.242 6.872

## house_age_years30 to 45 house_age_years0 to 15:n_convenience

## 8.113 0.834

## house_age_years15 to 30:n_convenience house_age_years30 to 45:n_convenience

## 0.852 0.669The expected increase in house price for each nearby convenience store is lowest for the 30 to 45 year age group.

For comparison, get the coefficients for the three models for each category.

# Get coefficients for mdl_0_to_15

coefficients(mdl_0_to_15)## (Intercept) n_convenience

## 9.242 0.834# Get coefficients for mdl_15_to_30

coefficients(mdl_15_to_30)## (Intercept) n_convenience

## 6.872 0.852# Get coefficients for mdl_30_to_45

coefficients(mdl_15_to_30)## (Intercept) n_convenience

## 6.872 0.852Sometimes fiddling about with how the model formula is specified makes it easier to interpret the coefficients. In this version, you can see how each category has its own intercept and slope (just like the 3 separate models had).

15.2.3 Predict with interactions

15.2.3.1 Predicting with interactions

mdl_price_vs_both_inter <- lm(price_twd_msq ~ house_age_years + n_convenience:house_age_years + 0, taiwan_real_estate)

# Make a grid of explanatory data

explanatory_data <- expand_grid(

# Set n_convenience to zero to ten

n_convenience = 0:10,

# Set house_age_years to the unique values of that variable

house_age_years = unique(taiwan_real_estate$house_age_years)

)

# See the result

explanatory_data## # A tibble: 33 × 2

## n_convenience house_age_years

## <int> <fct>

## 1 0 30 to 45

## 2 0 15 to 30

## 3 0 0 to 15

## 4 1 30 to 45

## 5 1 15 to 30

## 6 1 0 to 15

## 7 2 30 to 45

## 8 2 15 to 30

## 9 2 0 to 15

## 10 3 30 to 45

## # ℹ 23 more rows# Add predictions to the data frame

prediction_data <- explanatory_data %>%

mutate(price_twd_msq = predict(mdl_price_vs_both_inter, explanatory_data))

# See the result

prediction_data## # A tibble: 33 × 3

## n_convenience house_age_years price_twd_msq

## <int> <fct> <dbl>

## 1 0 30 to 45 8.11

## 2 0 15 to 30 6.87

## 3 0 0 to 15 9.24

## 4 1 30 to 45 8.78

## 5 1 15 to 30 7.72

## 6 1 0 to 15 10.1

## 7 2 30 to 45 9.45

## 8 2 15 to 30 8.58

## 9 2 0 to 15 10.9

## 10 3 30 to 45 10.1

## # ℹ 23 more rows# Using taiwan_real_estate, plot price vs. no. of convenience stores, colored by house age

ggplot(taiwan_real_estate, aes(n_convenience, price_twd_msq, color = house_age_years)) +

# Make it a scatter plot

geom_point() +

# Add linear regression trend lines, no ribbon

geom_smooth(method = "lm", se = FALSE)## `geom_smooth()` using formula = 'y ~ x'

# Add points from prediction_data, size 5, shape 15

geom_point(data = prediction_data, size = 5, shape = 15)## geom_point: na.rm = FALSE

## stat_identity: na.rm = FALSE

## position_identity15.2.3.2 Manually calculating predictions

For mdl_price_vs_both_inter model, there are three separate lines to calculate for, and in each one, the prediction is an intercept plus a slope times the numeric explanatory value.

# Get the coefficients from mdl_price_vs_both_inter

coeffs <- coefficients(mdl_price_vs_both_inter)

# Get the intercept for 0 to 15 year age group

intercept_0_15 <- coeffs[1]

# Get the intercept for 15 to 30 year age group

intercept_15_30 <- coeffs[2]

# Get the intercept for 30 to 45 year age group

intercept_30_45 <- coeffs[3]

# Get the slope for 0 to 15 year age group

slope_0_15 <- coeffs[4]

# Get the slope for 15 to 30 year age group

slope_15_30 <- coeffs[5]

# Get the slope for 30 to 45 year age group

slope_30_45 <- coeffs[6]

coeffs## house_age_years0 to 15 house_age_years15 to 30

## 9.242 6.872

## house_age_years30 to 45 house_age_years0 to 15:n_convenience

## 8.113 0.834

## house_age_years15 to 30:n_convenience house_age_years30 to 45:n_convenience

## 0.852 0.669prediction_data <- explanatory_data %>%

mutate(

# Consider the 3 cases to choose the price

price_twd_msq = case_when(

house_age_years == "0 to 15" ~ intercept_0_15 + slope_0_15 * n_convenience,

house_age_years == "15 to 30" ~ intercept_15_30 + slope_15_30 * n_convenience,

house_age_years == "30 to 45" ~ intercept_30_45 + slope_30_45 * n_convenience

)

)

# See the result

prediction_data## # A tibble: 33 × 3

## n_convenience house_age_years price_twd_msq

## <int> <fct> <dbl>

## 1 0 30 to 45 8.11

## 2 0 15 to 30 6.87

## 3 0 0 to 15 9.24

## 4 1 30 to 45 8.78

## 5 1 15 to 30 7.72

## 6 1 0 to 15 10.1

## 7 2 30 to 45 9.45

## 8 2 15 to 30 8.58

## 9 2 0 to 15 10.9

## 10 3 30 to 45 10.1

## # ℹ 23 more rows15.2.4 Simpson’s Paradox

Simpson’s Paradox occurs when the trend (trend = slope coefficient) of a model on the whole dataset is very different from the trends shown by models on subsets of the dataset.

You can’t choose the best model in general — it depends on the dataset and the question you are trying to answer.

Usually (but not always) the grouped model contains more insight.

15.2.4.1 Modeling

Sometimes modeling a whole dataset suggests trends that disagree with models on separate parts of that dataset. This is known as Simpson’s paradox.

In the most extreme case, you may see a positive slope on the whole dataset, and negative slopes on every subset of that dataset (or the other way around).

You’ll look at eBay auctions of Palm Pilot M515 PDA models.

price: Final sale price, USDopenbid: The opening bid, USDauction_type: How long did the auction last?

auctions <- read_tsv("data/auctions.txt")

# Take a glimpse at the dataset

glimpse(auctions)## Rows: 343

## Columns: 3

## $ price <dbl> 260, 257, 260, 238, 232, 251, 248, 238, 232, 242, 250, 24…

## $ openbid <dbl> 0.01, 0.01, 0.01, 0.01, 1.00, 9.99, 215.00, 155.00, 50.00…

## $ auction_type <chr> "7 day auction", "3 day auction", "5 day auction", "7 day…Fit a linear regression model of price versus openbid. Look at the coefficients.

# Model price vs. opening bid using auctions

mdl_price_vs_openbid <- lm(price ~ openbid, auctions)

# See the result

mdl_price_vs_openbid##

## Call:

## lm(formula = price ~ openbid, data = auctions)

##

## Coefficients:

## (Intercept) openbid

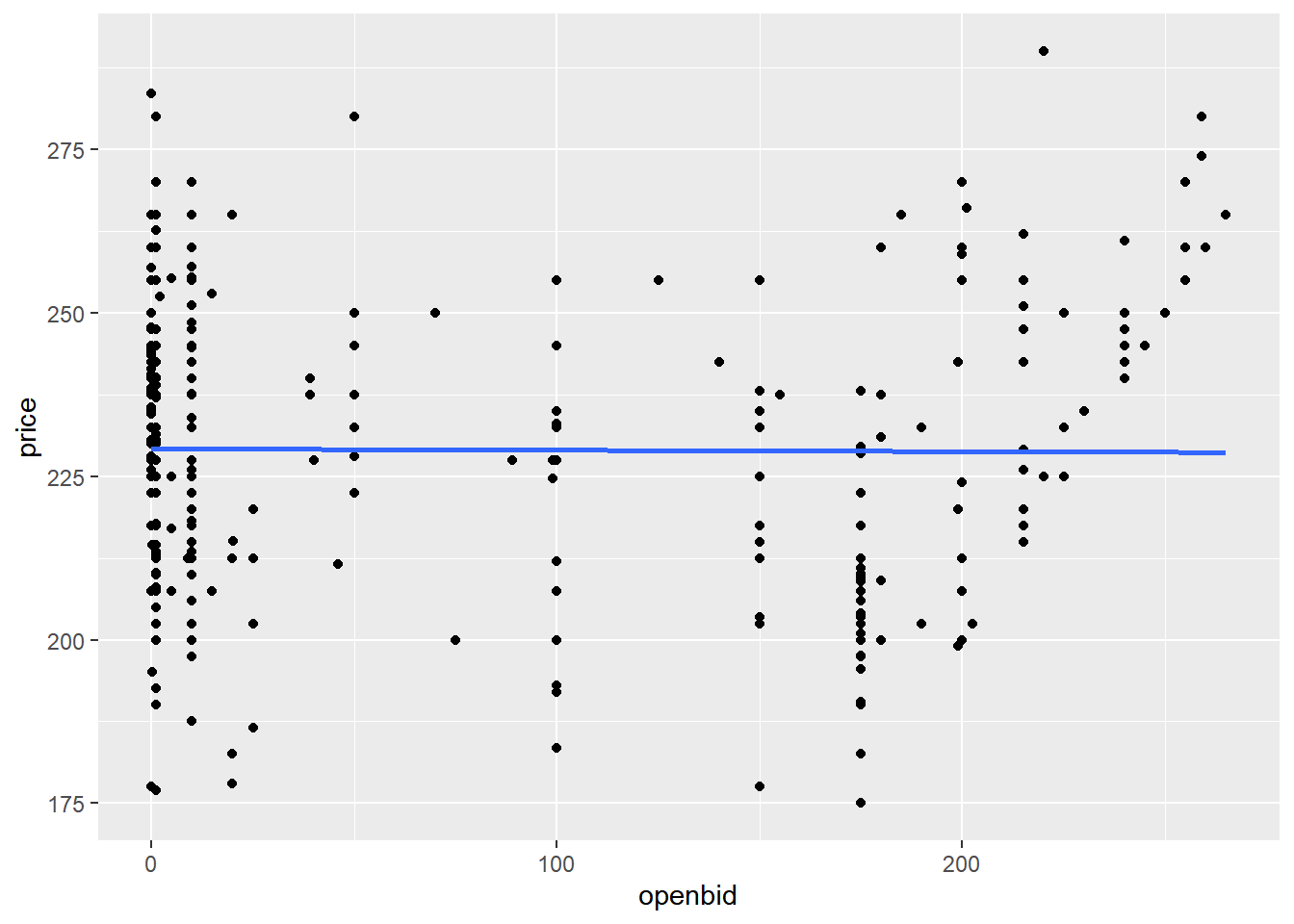

## 229.2457 -0.0021Plot price versus openbid as a scatter plot with linear regression trend lines (no ribbon). Look at the trend line.

# Using auctions, plot price vs. opening bid as a scatter plot with linear regression trend lines

ggplot(auctions, aes(openbid, price)) +

geom_point() +

geom_smooth(method = "lm", se = FALSE)## `geom_smooth()` using formula = 'y ~ x'

The slope coefficient is small enough that it might as well be zero. That is, opening bid appears to have no effect on the final sale price for Palm Pilots.

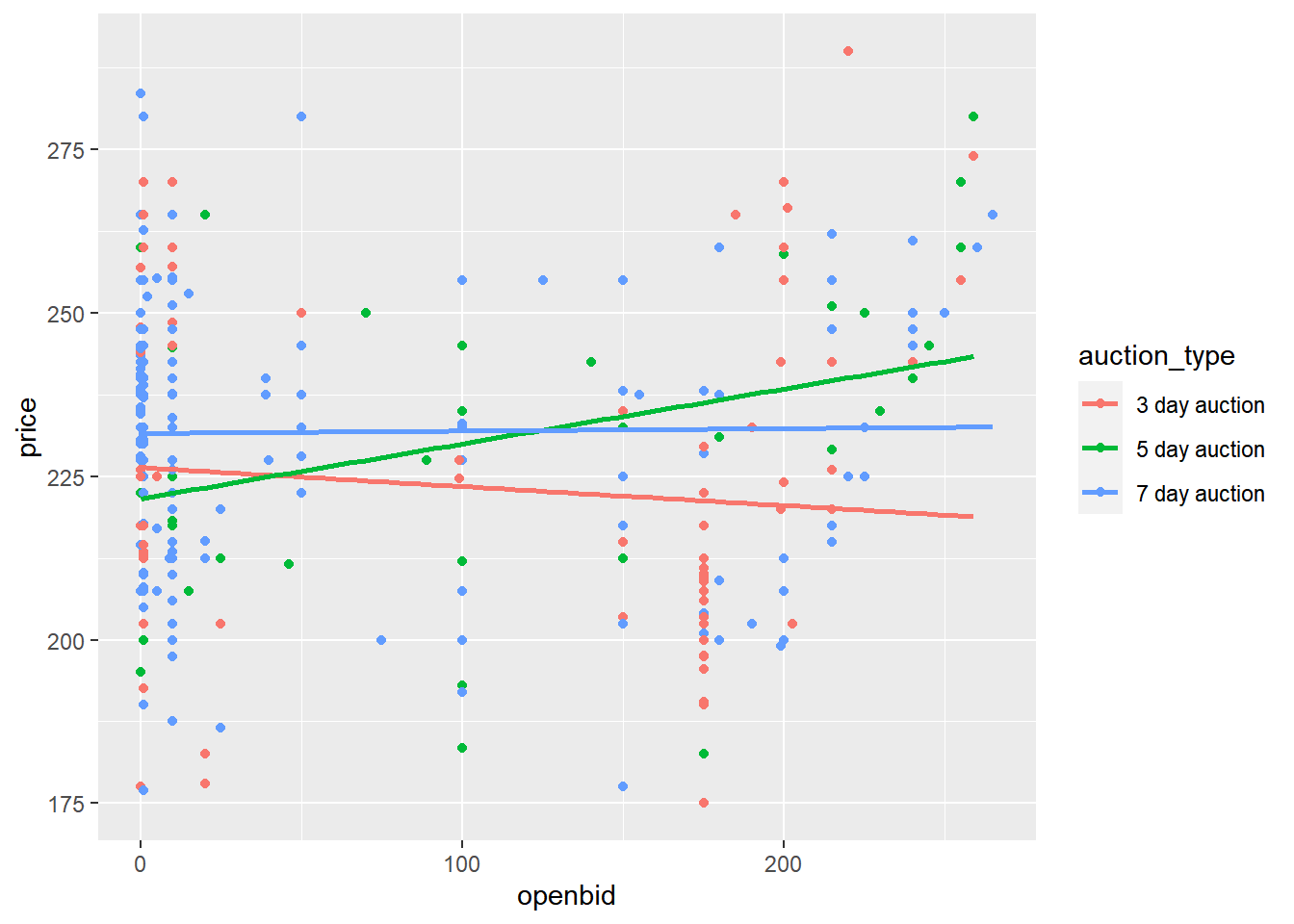

15.2.4.2 Modeling each category type

Now let’s look at what happens when you model the three auction types (3 day, 5 day, and 7 day) separately.

# Fit linear regression of price vs. opening bid and auction type, with an interaction.

mdl_price_vs_both <- lm(price ~ openbid + auction_type + auction_type:openbid, auctions)

# See the result

mdl_price_vs_both##

## Call:

## lm(formula = price ~ openbid + auction_type + auction_type:openbid,

## data = auctions)

##

## Coefficients:

## (Intercept) openbid

## 226.3690 -0.0290

## auction_type5 day auction auction_type7 day auction

## -4.7697 5.2339

## openbid:auction_type5 day auction openbid:auction_type7 day auction

## 0.1130 0.0327# Using auctions, plot price vs. opening bid colored by auction type as a scatter plot with linear regr'n trend lines

ggplot(auctions, aes(openbid, price, color = auction_type)) +

geom_point() +

geom_smooth(method = "lm", se = F)## `geom_smooth()` using formula = 'y ~ x'

Interpreting models is a subtle art, and your conclusions need to be based on the question you are trying to answer.

Here, the answer to ‘Does opening bid affect final sale price?’ is no overall.

But the answer to ‘Does opening bid price affect final sale price for any type of auction?’ is yes, for 5 day auctions.

15.3 Multiple Linear Regression

15.3.1 Two numeric IVs

Visualizing 3 numeric variables

3D scatter plot

2D scatter plot with response as color

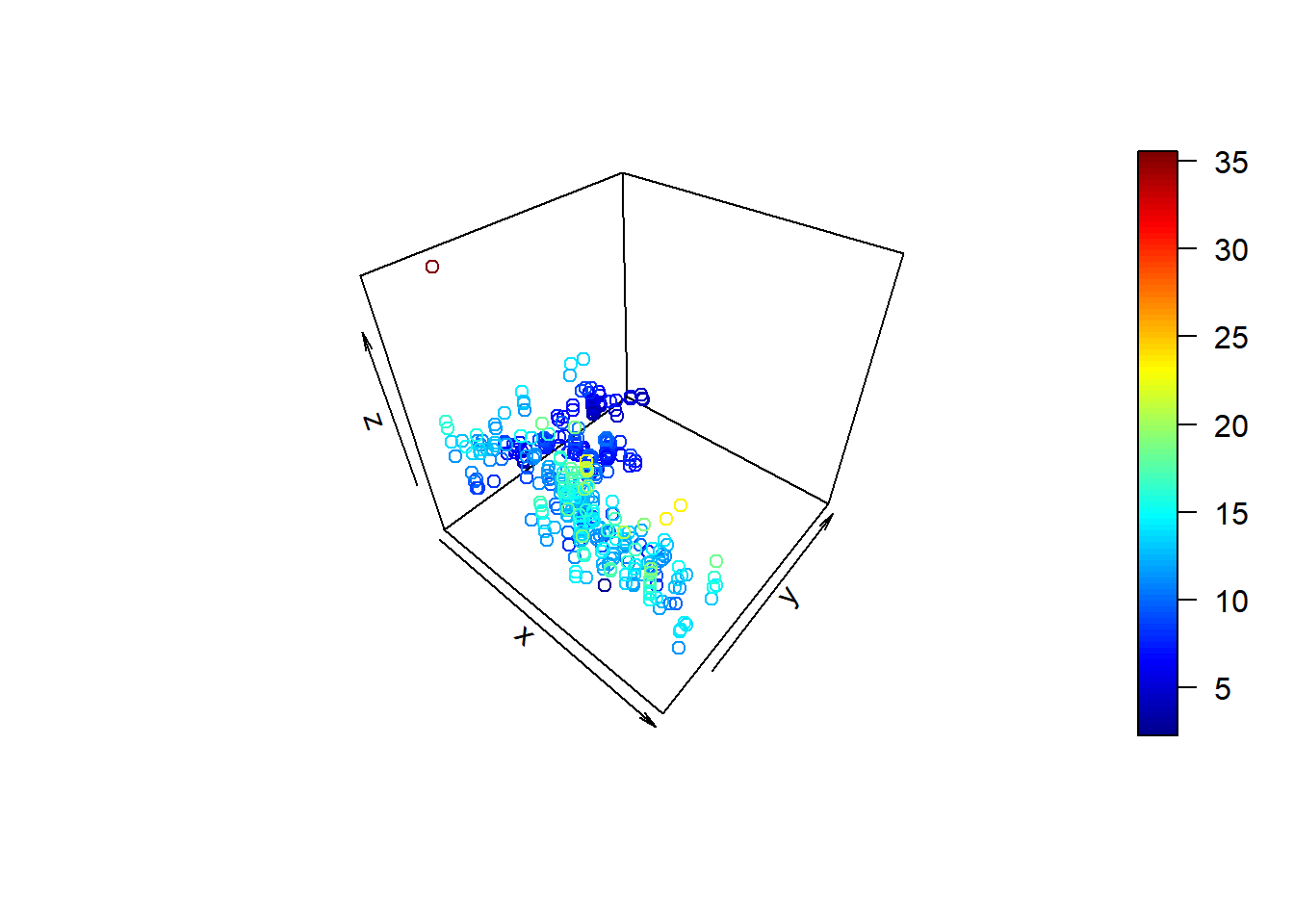

15.3.1.1 3D visualizations

For the case of three continuous variables, you can draw a 3D scatter plot, but perspective problems usually make it difficult to interpret.

There are some “flat” alternatives that provide easier interpretation, though they require a little thinking about to make.

# 3D scatter plot

library(plot3D)

scatter3D(fish$length_cm, fish$height_cm, fish$mass_g)

# cleaner code

library(plot3D)

library(magrittr)

fish %$%

scatter3D(length_cm, height_cm, mass_g)With the taiwan_real_estate dataset, draw a 3D scatter plot of the number of nearby convenience stores on the x-axis, the square-root of the distance to the nearest MRT stop on the y-axis, and the house price on the z-axis.

library(magrittr)

library(plot3D)## Warning: package 'plot3D' was built under R version 4.3.2# With taiwan_real_estate, draw a 3D scatter plot of no. of conv. stores, sqrt dist to MRT, and price

taiwan_real_estate %$%

scatter3D(n_convenience, sqrt(dist_to_mrt_m), price_twd_msq)

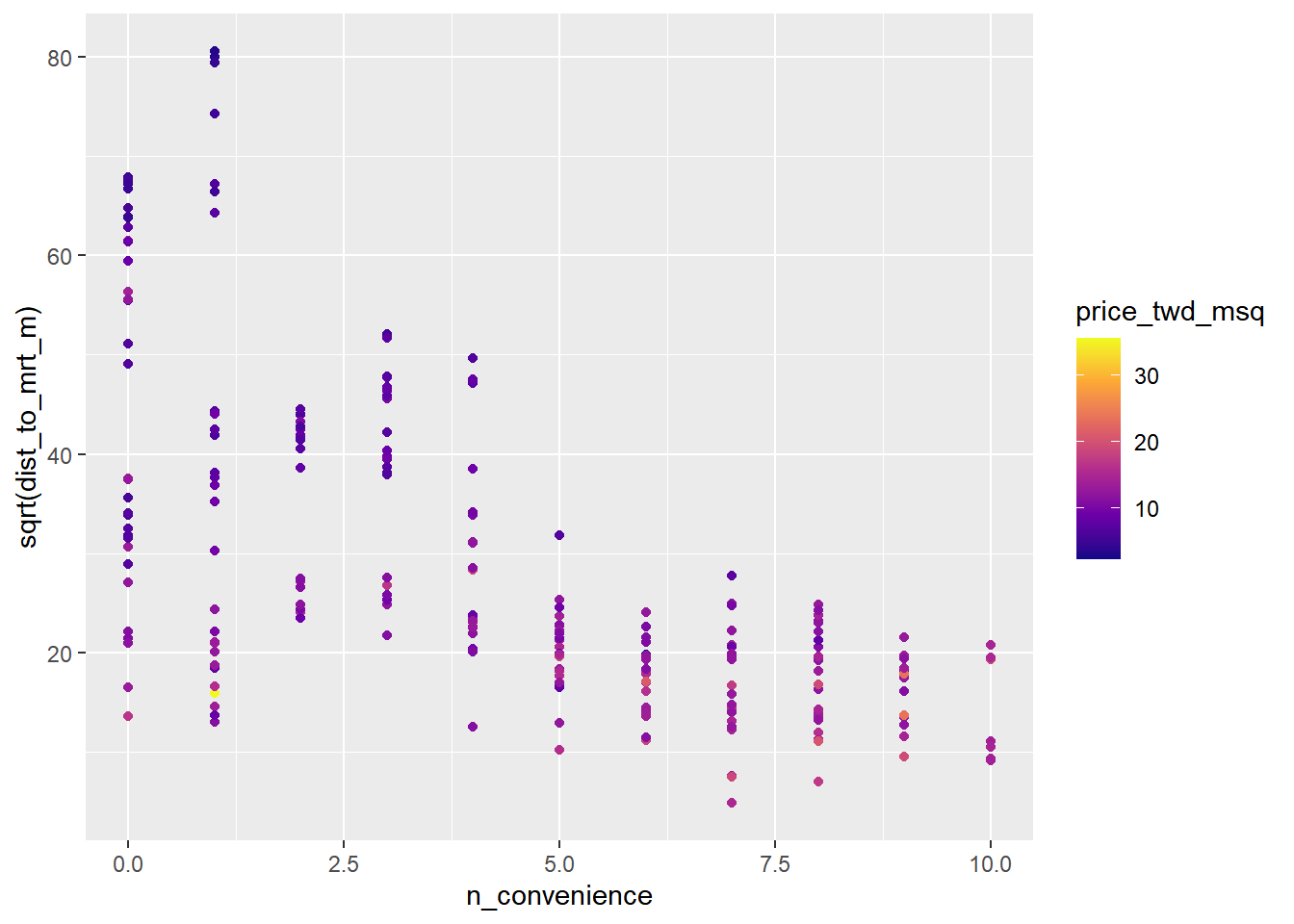

Use the continuous viridis color scale with scatter plot, using the "plasma" option.

# Using taiwan_real_estate, plot sqrt dist to MRT vs. no. of conv stores, colored by price

ggplot(taiwan_real_estate, aes(n_convenience, sqrt(dist_to_mrt_m), color = price_twd_msq)) +

# Make it a scatter plot

geom_point() +

# Use the continuous viridis plasma color scale

scale_color_viridis_c(option = "plasma")

3D scatter plots are usually a pain to easily interpret due to problems with perspective. The best alternative for displaying a third variable involves using colors.

15.3.1.2 Modeling 2 numeric IVs

The code for modeling and predicting with two numeric explanatory variables in the same, other than a slight difference in how to specify the explanatory variables to make predictions against.

Here you’ll model and predict the house prices against the number of nearby convenience stores and the square-root of the distance to the nearest MRT station.

# Fit a linear regression of price vs. no. of conv. stores and sqrt dist. to nearest MRT, no interaction

mdl_price_vs_conv_dist <- lm(price_twd_msq ~ n_convenience + sqrt(dist_to_mrt_m), taiwan_real_estate)

# See the result

mdl_price_vs_conv_dist##

## Call:

## lm(formula = price_twd_msq ~ n_convenience + sqrt(dist_to_mrt_m),

## data = taiwan_real_estate)

##

## Coefficients:

## (Intercept) n_convenience sqrt(dist_to_mrt_m)

## 15.104 0.214 -0.157Create expanded grid of explanatory variables with number of convenience stores from 0 to 10 and the distance to the nearest MRT station as a sequence from 0 to 80 in steps of 10, all squared (0, 100, 400, …, 6400).

# Create expanded grid of explanatory variables with no. of conv. stores and dist. to nearest MRT

explanatory_data <- expand_grid(

n_convenience = 0:10,

dist_to_mrt_m = seq(0, 80, 10)^2

)

# Add predictions using mdl_price_vs_conv_dist and explanatory_data

prediction_data <- explanatory_data %>%

mutate(price_twd_msq = predict(mdl_price_vs_conv_dist, explanatory_data))

# See the result

prediction_data## # A tibble: 99 × 3

## n_convenience dist_to_mrt_m price_twd_msq

## <int> <dbl> <dbl>

## 1 0 0 15.1

## 2 0 100 13.5

## 3 0 400 12.0

## 4 0 900 10.4

## 5 0 1600 8.81

## 6 0 2500 7.24

## 7 0 3600 5.67

## 8 0 4900 4.09

## 9 0 6400 2.52

## 10 1 0 15.3

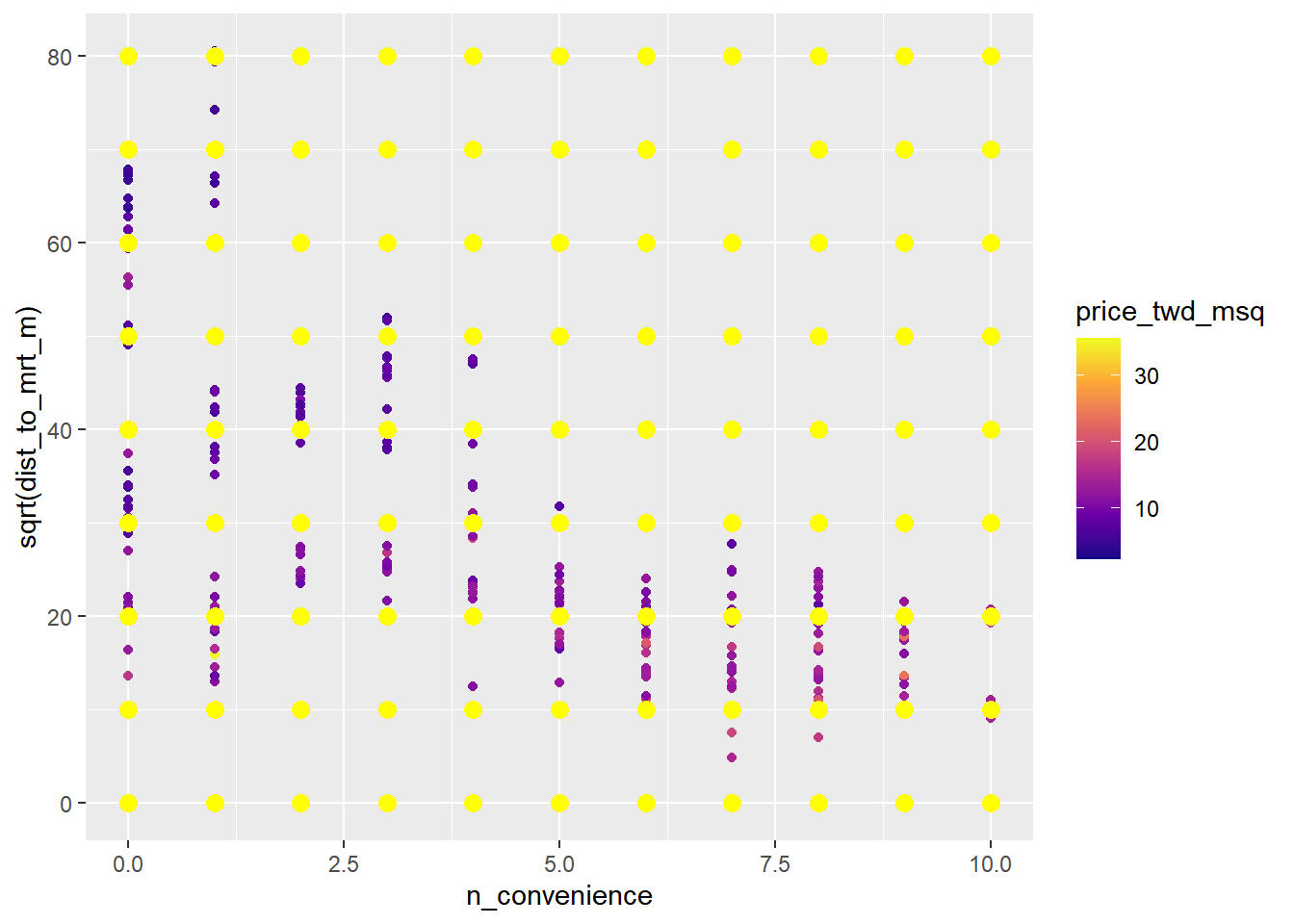

## # ℹ 89 more rowsExtend the plot to add a layer of points using the prediction data.

# Add predictions to plot

ggplot(

taiwan_real_estate,

aes(n_convenience, sqrt(dist_to_mrt_m), color = price_twd_msq)

) +

geom_point() +

scale_color_viridis_c(option = "plasma")+

# Add prediction points colored yellow, size 3

geom_point(data = prediction_data, color = "yellow", size = 3)

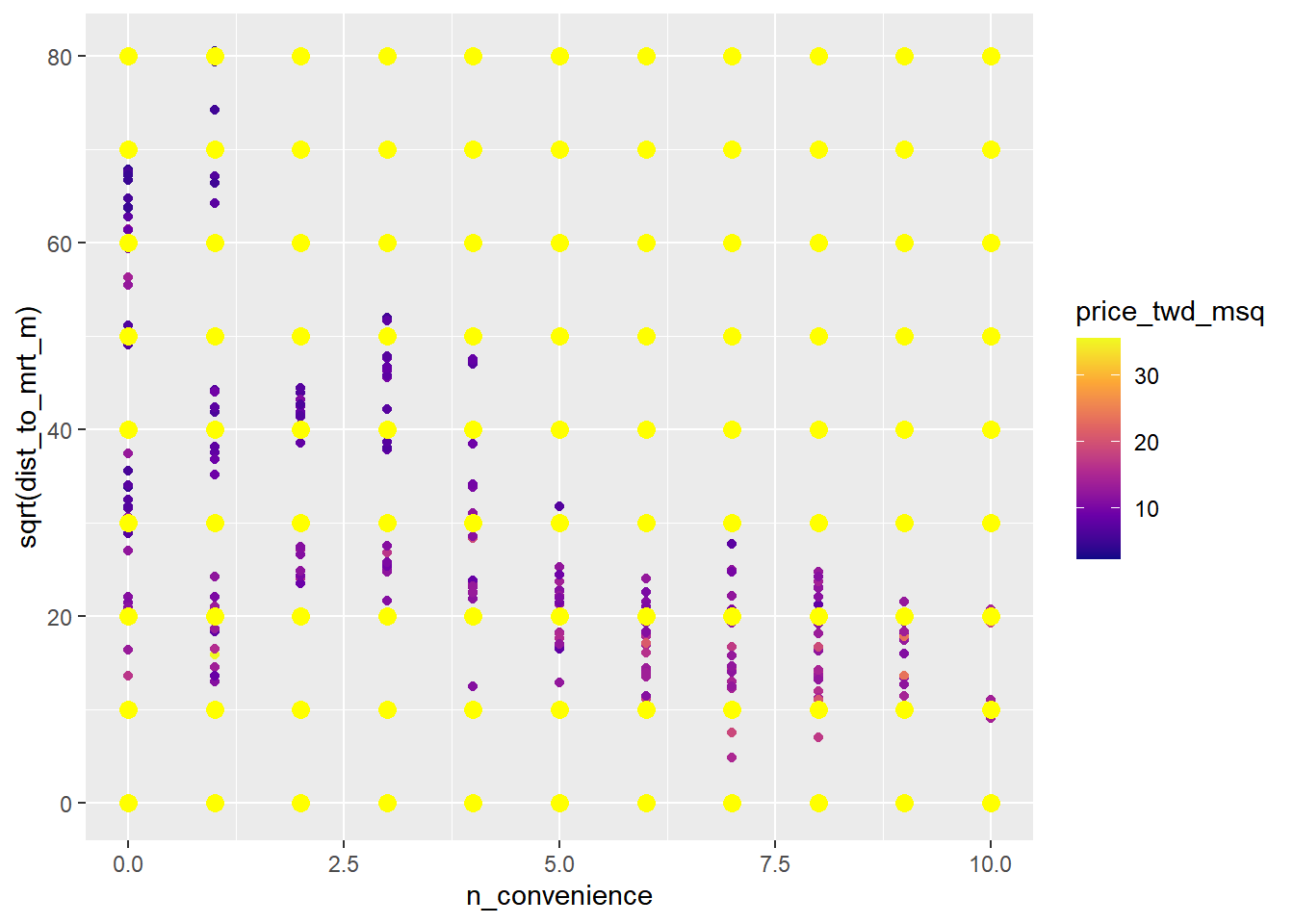

15.3.1.3 Including an interaction

Here you’ll run and predict the same model as in the previous exercise, but this time including an interaction between the explanatory variables.

# Fit a linear regression of price vs. no. of conv. stores and sqrt dist. to nearest MRT, with interaction

mdl_price_vs_conv_dist <- lm(price_twd_msq ~ n_convenience * sqrt(dist_to_mrt_m), taiwan_real_estate)

# See the result

mdl_price_vs_conv_dist##

## Call:

## lm(formula = price_twd_msq ~ n_convenience * sqrt(dist_to_mrt_m),

## data = taiwan_real_estate)

##

## Coefficients:

## (Intercept) n_convenience

## 14.7373 0.4243

## sqrt(dist_to_mrt_m) n_convenience:sqrt(dist_to_mrt_m)

## -0.1412 -0.0112# Create expanded grid of explanatory variables with no. of conv. stores and dist. to nearest MRT

explanatory_data <- expand_grid(

n_convenience = 0:10,

dist_to_mrt_m = seq(0, 80, 10)^2

)

# Add predictions using mdl_price_vs_conv_dist and explanatory_data

prediction_data <- explanatory_data %>%

mutate(price_twd_msq = predict(mdl_price_vs_conv_dist, explanatory_data))

# See the result

prediction_data## # A tibble: 99 × 3

## n_convenience dist_to_mrt_m price_twd_msq

## <int> <dbl> <dbl>

## 1 0 0 14.7

## 2 0 100 13.3

## 3 0 400 11.9

## 4 0 900 10.5

## 5 0 1600 9.09

## 6 0 2500 7.68

## 7 0 3600 6.26

## 8 0 4900 4.85

## 9 0 6400 3.44

## 10 1 0 15.2

## # ℹ 89 more rows# Add predictions to plot

ggplot(

taiwan_real_estate,

aes(n_convenience, sqrt(dist_to_mrt_m), color = price_twd_msq)

) +

geom_point() +

scale_color_viridis_c(option = "plasma") +

# Add prediction points colored yellow, size 3

geom_point(data = prediction_data, color = "yellow", size = 3)

15.3.2 More than 2 IVs

15.3.2.1 Visualizing many variables

In addition to using x and y scales for two numeric variables, you can use color for a third numeric variable, and you can use faceting for categorical variables. And that’s about your limit before the plots become to difficult to interpret.

Here you’ll push the limits of the scatter plot by showing the house price, the distance to the MRT station, the number of nearby convenience stores, and the house age, all together in one plot.

# Using taiwan_real_estate, no. of conv. stores vs. sqrt of dist. to MRT, colored by plot house price

ggplot(taiwan_real_estate,

aes(sqrt(dist_to_mrt_m), n_convenience, color = price_twd_msq)) +

# Make it a scatter plot

geom_point() +

# Use the continuous viridis plasma color scale

scale_color_viridis_c(option = "plasma") +

# Facet, wrapped by house age

facet_wrap(~ house_age_years)

15.3.2.2 Different levels of interaction

No interactions

response ~ explntry1 + explntry2 + explntry3

2-way interactions between pairs of variables

response ~ explntry1 + explntry2 + explntry3 + explntry1:explntry2 + explntry1:explntry3 + explntry2:explntry3the same as

response ~ (explntry1 + explntry2 + explntry3) ^ 2

3-way interaction between all three variables

response ~ explntry1 + explntry2 + explntry3 + explntry1:explntry2 + explntry1:explntry3 + explntry2:explntry3 + explntry1:explntry2:explntry3the same as

response ~ explntry1 * explntry2 * explntry3

Don’t include a global intercept, and any interactions.

# Model price vs. no. of conv. stores, sqrt dist. to MRT station & house age, no global intercept, no interactions

mdl_price_vs_all_no_inter <- lm(price_twd_msq ~ n_convenience + sqrt(dist_to_mrt_m) + house_age_years + 0, taiwan_real_estate)

# See the result

mdl_price_vs_all_no_inter##

## Call:

## lm(formula = price_twd_msq ~ n_convenience + sqrt(dist_to_mrt_m) +

## house_age_years + 0, data = taiwan_real_estate)

##

## Coefficients:

## n_convenience sqrt(dist_to_mrt_m) house_age_years0 to 15

## 0.258 -0.148 15.474

## house_age_years15 to 30 house_age_years30 to 45

## 14.130 13.765Don’t include a global intercept, but do include 2-way and 3-way interactions between the explanatory variables.

# Model price vs. sqrt dist. to MRT station, no. of conv. stores & house age, no global intercept, 3-way interactions

mdl_price_vs_all_3_way_inter <- lm(

price_twd_msq ~ sqrt(dist_to_mrt_m) * n_convenience * house_age_years + 0,

taiwan_real_estate)

# See the result

mdl_price_vs_all_3_way_inter##

## Call:

## lm(formula = price_twd_msq ~ sqrt(dist_to_mrt_m) * n_convenience *

## house_age_years + 0, data = taiwan_real_estate)

##

## Coefficients:

## sqrt(dist_to_mrt_m)

## -0.16294

## n_convenience

## 0.37498

## house_age_years0 to 15

## 16.04685

## house_age_years15 to 30

## 13.76007

## house_age_years30 to 45

## 12.08877

## sqrt(dist_to_mrt_m):n_convenience

## -0.00839

## sqrt(dist_to_mrt_m):house_age_years15 to 30

## 0.03662

## sqrt(dist_to_mrt_m):house_age_years30 to 45

## 0.06128

## n_convenience:house_age_years15 to 30

## 0.07837

## n_convenience:house_age_years30 to 45

## 0.06672

## sqrt(dist_to_mrt_m):n_convenience:house_age_years15 to 30

## -0.00382

## sqrt(dist_to_mrt_m):n_convenience:house_age_years30 to 45

## 0.00440Don’t include a global intercept, but do include 2-way (not 3-way) interactions between the explanatory variables.

# Model price vs. sqrt dist. to MRT station, no. of conv. stores & house age, no global intercept, 2-way interactions

mdl_price_vs_all_2_way_inter <- lm(

price_twd_msq ~ (sqrt(dist_to_mrt_m) + n_convenience + house_age_years)^2 + 0,

taiwan_real_estate)

# See the result

mdl_price_vs_all_2_way_inter##

## Call:

## lm(formula = price_twd_msq ~ (sqrt(dist_to_mrt_m) + n_convenience +

## house_age_years)^2 + 0, data = taiwan_real_estate)

##

## Coefficients:

## sqrt(dist_to_mrt_m)

## -0.16202

## n_convenience

## 0.38491

## house_age_years0 to 15

## 16.02663

## house_age_years15 to 30

## 13.88079

## house_age_years30 to 45

## 11.92690

## sqrt(dist_to_mrt_m):n_convenience

## -0.00896

## sqrt(dist_to_mrt_m):house_age_years15 to 30

## 0.03160

## sqrt(dist_to_mrt_m):house_age_years30 to 45

## 0.06820

## n_convenience:house_age_years15 to 30

## -0.00689

## n_convenience:house_age_years30 to 45

## 0.1434215.3.2.3 Predicting

# Make a grid of explanatory data

explanatory_data <- expand_grid(

# Set dist_to_mrt_m a seq from 0 to 80 by 10s, squared

dist_to_mrt_m = seq(0, 80, 10) ^ 2,

# Set n_convenience to 0 to 10

n_convenience = 0:10,

# Set house_age_years to the unique values of that variable

house_age_years = unique(taiwan_real_estate$house_age_years)

)

# See the result

explanatory_data## # A tibble: 297 × 3

## dist_to_mrt_m n_convenience house_age_years

## <dbl> <int> <fct>

## 1 0 0 30 to 45

## 2 0 0 15 to 30

## 3 0 0 0 to 15

## 4 0 1 30 to 45

## 5 0 1 15 to 30

## 6 0 1 0 to 15

## 7 0 2 30 to 45

## 8 0 2 15 to 30

## 9 0 2 0 to 15

## 10 0 3 30 to 45

## # ℹ 287 more rows# Add predictions to the data frame

prediction_data <- explanatory_data %>%

mutate(price_twd_msq = predict(mdl_price_vs_all_3_way_inter, explanatory_data))

# See the result

prediction_data## # A tibble: 297 × 4

## dist_to_mrt_m n_convenience house_age_years price_twd_msq

## <dbl> <int> <fct> <dbl>

## 1 0 0 30 to 45 12.1

## 2 0 0 15 to 30 13.8

## 3 0 0 0 to 15 16.0

## 4 0 1 30 to 45 12.5

## 5 0 1 15 to 30 14.2

## 6 0 1 0 to 15 16.4

## 7 0 2 30 to 45 13.0

## 8 0 2 15 to 30 14.7

## 9 0 2 0 to 15 16.8

## 10 0 3 30 to 45 13.4

## # ℹ 287 more rows# Extend the plot

ggplot(

taiwan_real_estate,

aes(sqrt(dist_to_mrt_m), n_convenience, color = price_twd_msq)) +

geom_point() +

scale_color_viridis_c(option = "plasma") +

facet_wrap(vars(house_age_years)) +

# Add points from prediction data, size 3, shape 15

geom_point(data = prediction_data, size = 3, shape = 15)

The plot nicely shows that the house price decreases as the square-root of the distance to the nearest MRT station increases, and increases as the number of nearby convenience stores increases, and is higher for houses under 15 years old.

15.3.3 Model performance

15.3.3.1 Sum of squares

In order to choose the “best” line to fit the data, regression models need to optimize some metric. For linear regression, this metric is called the sum of squares.

It takes the square of each residual, and add up those squares. So a smaller number is better.

15.3.3.2 Linear regression algorithm

The workflow is

Write a script to calculate the sum of squares.

Turn this into a function.

Use R’s general purpose optimization function find the coefficients that minimize this.

optim(par = c(var1 = int1, var2 = int2...), fn = function)

x_actual <- taiwan_real_estate$n_convenience

y_actual <- taiwan_real_estate$price_twd_msqCalculate the sum of squares.

# Set the intercept to 10

intercept <- 10

# Set the slope to 1

slope <- 1

# Calculate the predicted y values

y_pred <- intercept + slope * x_actual

# Calculate the differences between actual and predicted

y_diff <- y_pred - y_actual

# Calculate the sum of squares

sum(y_diff ^ 2)## [1] 7668Complete the function body.

calc_sum_of_squares <- function(coeffs) {

# Get the intercept coeff

intercept <- coeffs[1]

# Get the slope coeff

slope <- coeffs[2]

# Calculate the predicted y values

y_pred <- intercept + slope * x_actual

# Calculate the differences between actual and predicted

y_diff <- y_pred - y_actual

# Calculate the sum of squares

sum(y_diff ^ 2)

}Optimize the sum of squares metric.

# Optimize the metric

optim(

# Initially guess 0 intercept and 0 slope

par = c(intercept = 0, slope = 0),

# Use calc_sum_of_squares as the optimization fn

fn = calc_sum_of_squares

)## $par

## intercept slope

## 8.226 0.798

##

## $value

## [1] 4718

##

## $counts

## function gradient

## 87 NA

##

## $convergence

## [1] 0

##

## $message

## NULL# Compare the coefficients to those calculated by lm()

lm(price_twd_msq ~ n_convenience, data = taiwan_real_estate)##

## Call:

## lm(formula = price_twd_msq ~ n_convenience, data = taiwan_real_estate)

##

## Coefficients:

## (Intercept) n_convenience

## 8.224 0.798The sum of square is 4717.687

15.4 Multiple Logistic Regression

15.4.1 Multiple Logistic Regression

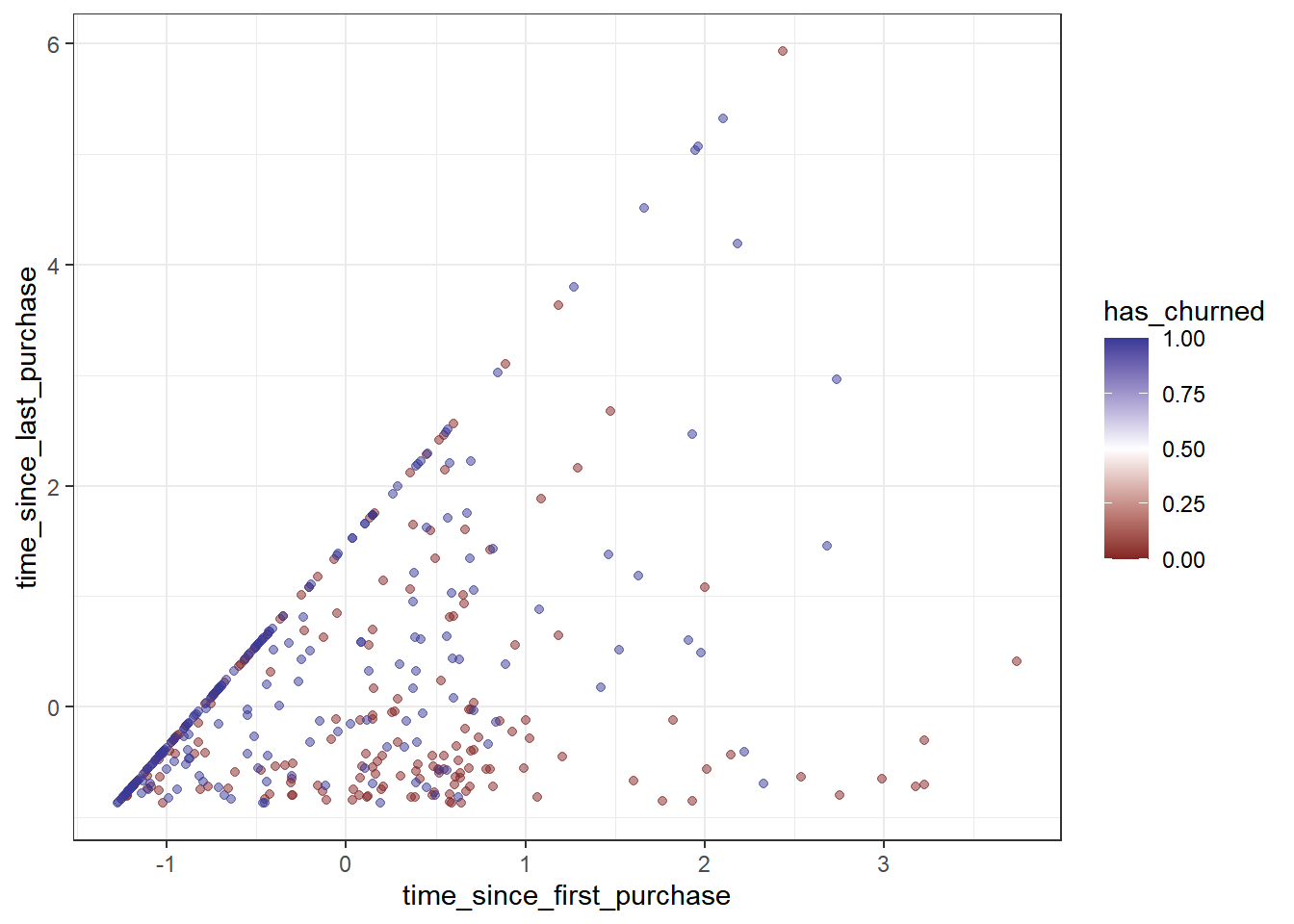

15.4.1.1 Visualizing

Use faceting for categorical variables.

For 2 numeric explanatory variables, use color for response.

Give responses below

0.5one color; responses above0.5another color.scale_color_gradient2(midpoint = 0.5)

Here we’ll look at the case of two numeric explanatory variables, and the solution is basically the same as before: use color to denote the response.

churn <- read_fst("data/churn.fst")

# Using churn, plot recency vs. length of relationship colored by churn status

ggplot(churn,

aes(time_since_first_purchase, time_since_last_purchase,

color = has_churned)) +

# Make it a scatter plot, with transparency 0.5

geom_point(alpha = 0.5) +

# Use a 2-color gradient split at 0.5

scale_color_gradient2(midpoint = 0.5) +

# Use the black and white theme

theme_bw()

The 2-color gradient is excellent for distinguishing the two cases of a positive and negative response.

15.4.1.2 With 2 IVs

With interaction:

glm(response ~ explanatory1 * explanatory2, data = dataset, family = binomial)

Here you’ll fit a model of churn status with both of the explanatory variables from the dataset: the length of customer relationship and the recency of purchase.

# Fit a logistic regression of churn status vs. length of relationship, recency, and an interaction

mdl_churn_vs_both_inter <- glm(

has_churned ~ time_since_first_purchase * time_since_last_purchase,

churn,

family = "binomial")

# See the result

mdl_churn_vs_both_inter##

## Call: glm(formula = has_churned ~ time_since_first_purchase * time_since_last_purchase,

## family = "binomial", data = churn)

##

## Coefficients:

## (Intercept)

## -0.151

## time_since_first_purchase

## -0.638

## time_since_last_purchase

## 0.423

## time_since_first_purchase:time_since_last_purchase

## 0.112

##

## Degrees of Freedom: 399 Total (i.e. Null); 396 Residual

## Null Deviance: 555

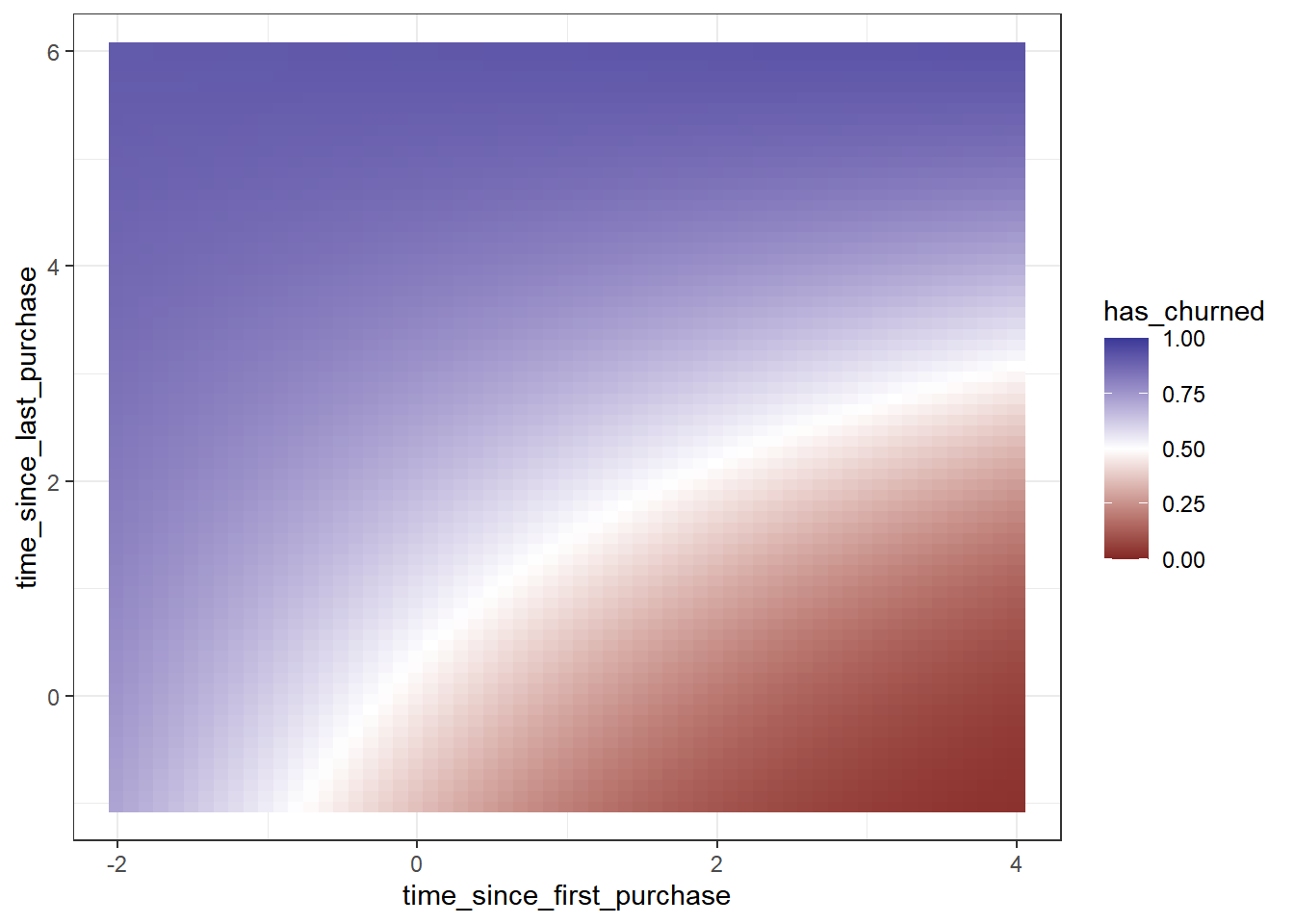

## Residual Deviance: 520 AIC: 52815.4.1.3 Predicting

The only thing to remember here is to set the prediction type to "response".

# Make a grid of explanatory data

explanatory_data <- expand_grid(

# Set len. relationship to seq from -2 to 4 in steps of 0.1

time_since_first_purchase = seq(-2, 4, 0.1),

# Set recency to seq from -1 to 6 in steps of 0.1

time_since_last_purchase = seq(-1, 6, 0.1)

)

# See the result

explanatory_data## # A tibble: 4,331 × 2

## time_since_first_purchase time_since_last_purchase

## <dbl> <dbl>

## 1 -2 -1

## 2 -2 -0.9

## 3 -2 -0.8

## 4 -2 -0.7

## 5 -2 -0.6

## 6 -2 -0.5

## 7 -2 -0.4

## 8 -2 -0.3

## 9 -2 -0.2

## 10 -2 -0.1

## # ℹ 4,321 more rows# Add a column of predictions using mdl_churn_vs_both_inter and explanatory_data with type response

prediction_data <- explanatory_data %>%

mutate(has_churned = predict(mdl_churn_vs_both_inter,

explanatory_data,

type = "response"))

# See the result

prediction_data## # A tibble: 4,331 × 3

## time_since_first_purchase time_since_last_purchase has_churned

## <dbl> <dbl> <dbl>

## 1 -2 -1 0.716

## 2 -2 -0.9 0.720

## 3 -2 -0.8 0.724

## 4 -2 -0.7 0.728

## 5 -2 -0.6 0.732

## 6 -2 -0.5 0.736

## 7 -2 -0.4 0.740

## 8 -2 -0.3 0.744

## 9 -2 -0.2 0.747

## 10 -2 -0.1 0.751

## # ℹ 4,321 more rows# Extend the plot

ggplot(churn,

aes(time_since_first_purchase,

time_since_last_purchase,

color = has_churned)) +

geom_point(alpha = 0.5) +

scale_color_gradient2(midpoint = 0.5) +

theme_bw() +

# Add points from prediction_data with size 3 and shape 15

geom_point(data = prediction_data, size = 3, shape = 15)

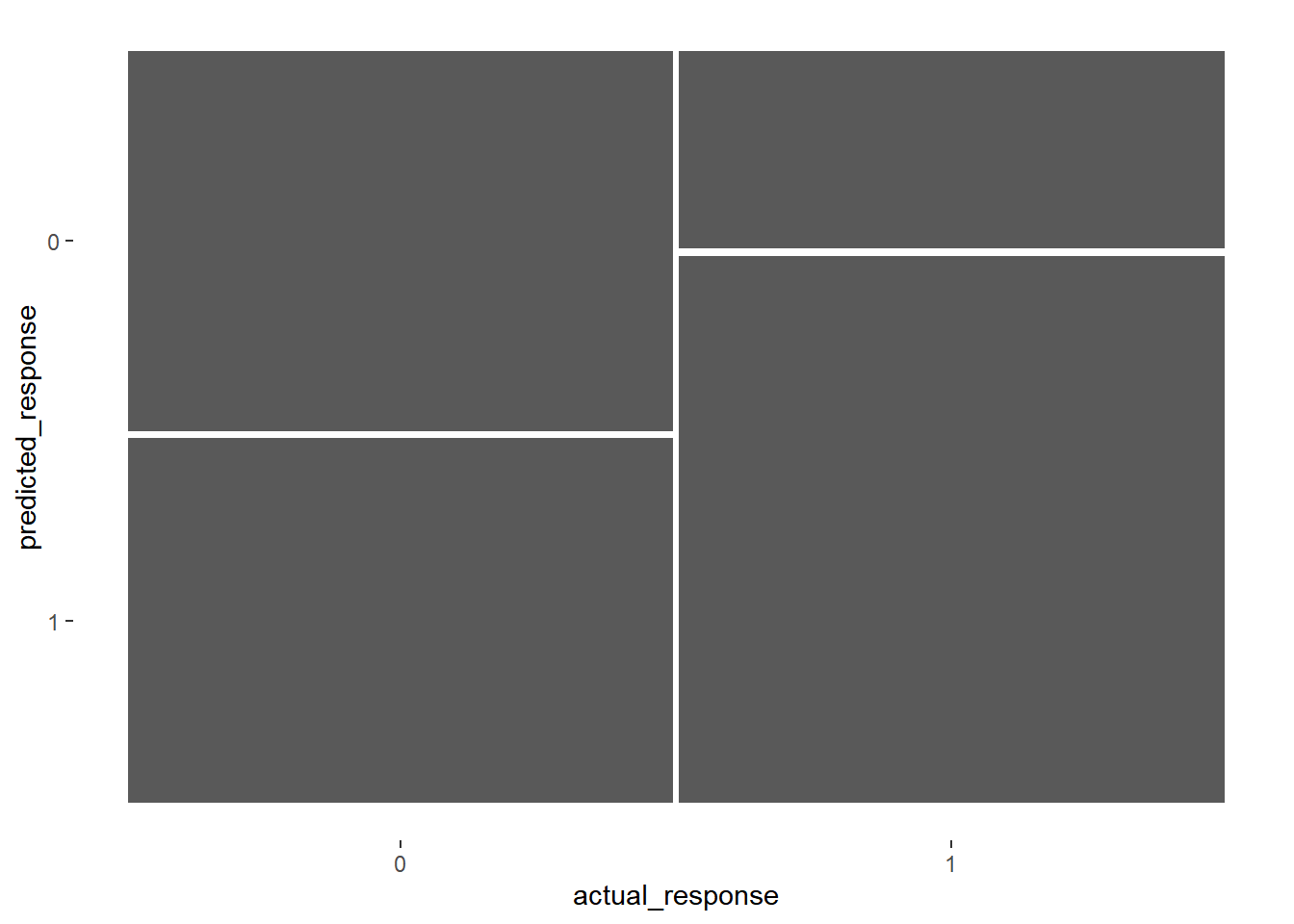

15.4.1.4 Confusion matrix

Generating a confusion matrix and calculating metrics like accuracy, sensitivity, and specificity is the standard way to measure how well a logistic model fits.

Get the predicted responses from the rounded, fitted values of mdl_churn_vs_both_inter.

library(yardstick)## Warning: package 'yardstick' was built under R version 4.3.2# Get the actual responses from churn

actual_response <- churn$has_churned

# Get the predicted responses from the model

predicted_response <- round(fitted(mdl_churn_vs_both_inter))

# Get a table of these values

outcomes <- table(predicted_response, actual_response)

# Convert the table to a conf_mat object

confusion <- conf_mat(outcomes)

# See the result

confusion## actual_response

## predicted_response 0 1

## 0 102 53

## 1 98 147Remember that the churn event is in the second row/column of the matrix.

# "Automatically" plot the confusion matrix

autoplot(confusion)

# Get summary metrics

summary(confusion, event_level = "second")## # A tibble: 13 × 3

## .metric .estimator .estimate

## <chr> <chr> <dbl>

## 1 accuracy binary 0.622

## 2 kap binary 0.245

## 3 sens binary 0.735

## 4 spec binary 0.51

## 5 ppv binary 0.6

## 6 npv binary 0.658

## 7 mcc binary 0.251

## 8 j_index binary 0.245

## 9 bal_accuracy binary 0.622

## 10 detection_prevalence binary 0.612

## 11 precision binary 0.6

## 12 recall binary 0.735

## 13 f_meas binary 0.66115.4.2 Logistic distribution

Distribution function names

| curve | prefix | normal | logistic | nmemonic |

|---|---|---|---|---|

| Probability density function (PDF) | d | dnorm() |

dlogis() |

“d” for differentiate - you differentiate the CDF to get the PDF |

| Cumulative distribution function (CDF) | p | pnorm() |

plogis() |

“p” is backwards “q” so it’s the inverse of the inverse CDF |

| Inverse CDF | q | qnorm() |

qlogis() |

“q” for quantile |

family = gaussian |

family = binomial |

|||

15.4.2.1 CDF & Inverse CDF

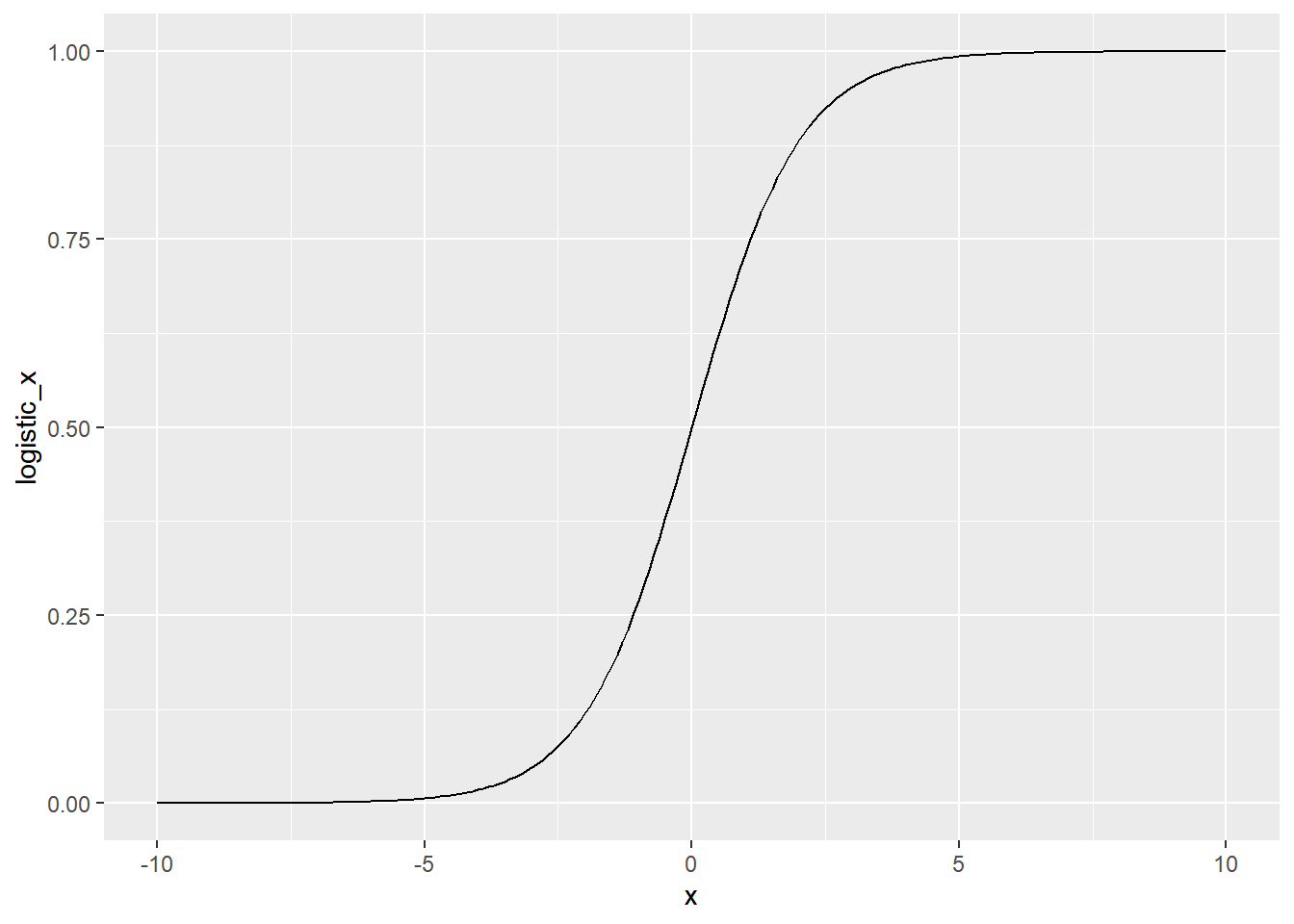

Logistic distribution CDF is also called the logistic function.

\(cdf(x) = 1 / (1 + exp(-x))\)

The plot of this has an S-shape, known as a sigmoid curve.

This function takes an input that can be any number from minus infinity to infinity, and returns a value between zero and one.

Each x input value is transformed to a unique value. That means that the transformation can be reversed.

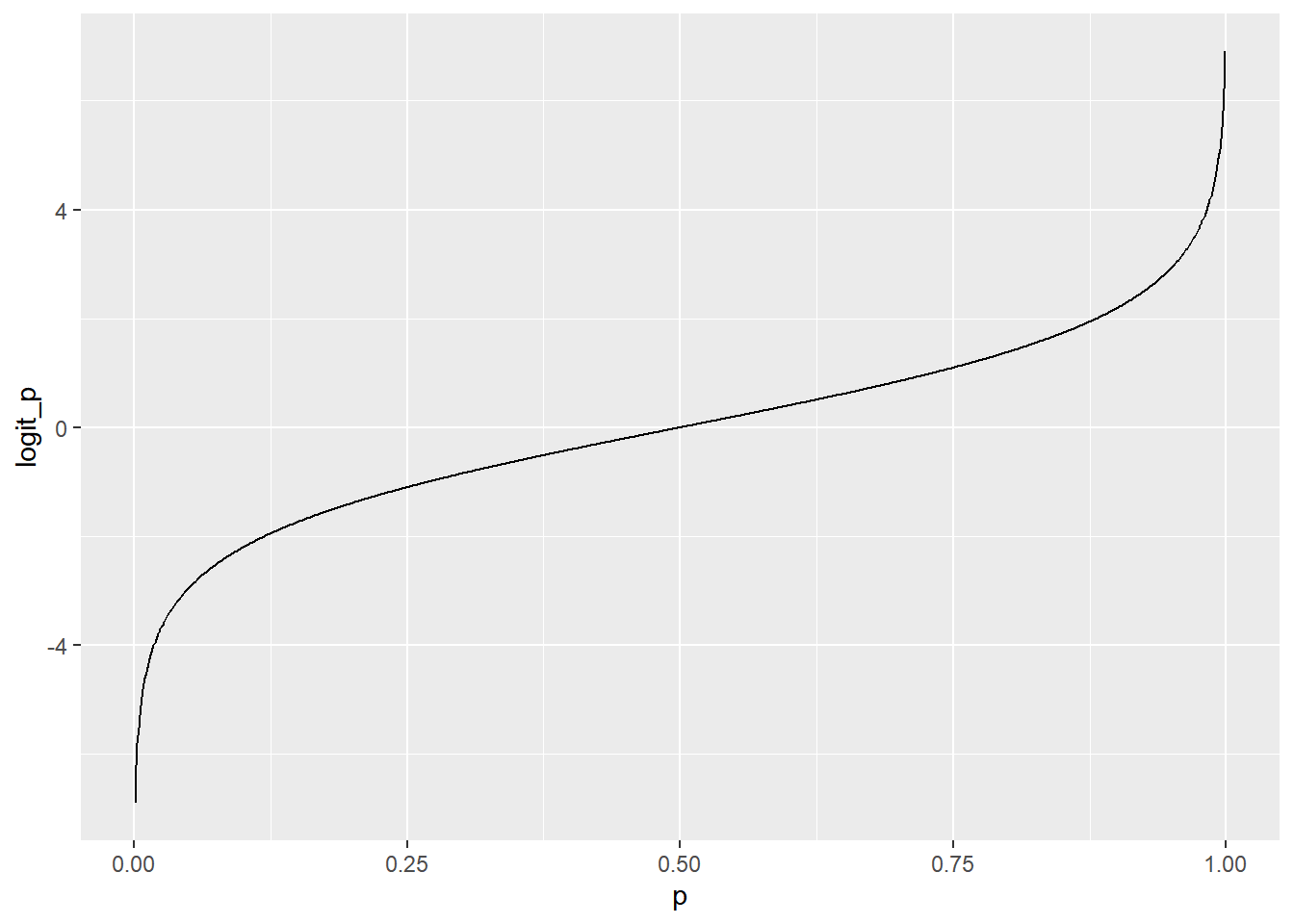

Logistic distribution inverse CDF is also called the logit function.

- \(inverse\_cdf(p) = log(p / (1 - p))\)

Cumulative distribution function

Like the normal (Gaussian) distribution, it is a probability distribution of a single continuous variable. Here you’ll visualize the cumulative distribution function (CDF) for the logistic distribution.

logistic_distn_cdf <- tibble(

# Make a seq from -10 to 10 in steps of 0.1

x = seq(-10, 10, 0.1),

# Transform x with built-in logistic CDF

logistic_x = plogis(x),

# Transform x with manual logistic

logistic_x_man = 1 / (1 + exp(-x))

)

# Check that each logistic function gives the same results

all.equal(

logistic_distn_cdf$logistic_x,

logistic_distn_cdf$logistic_x_man

)## [1] TRUEThe logistic distribution’s cumulative distribution function is a sigmoid curve.

# Using logistic_distn_cdf, plot logistic_x vs. x

ggplot(logistic_distn_cdf, aes(x, logistic_x)) +

# Make it a line plot

geom_line()

Inverse cumulative distribution function

logistic_distn_inv_cdf <- tibble(

# Make a seq from 0.001 to 0.999 in steps of 0.001

p = seq(0.001, 0.999, 0.001),

# Transform with built-in logistic inverse CDF

logit_p = qlogis(p),

# Transform with manual logit

logit_p_man = log(p / (1 - p))

)

# Check that each logistic function gives the same results

all.equal(

logistic_distn_inv_cdf$logit_p,

logistic_distn_inv_cdf$logit_p_man

)## [1] TRUE# Using logistic_distn_inv_cdf, plot logit_p vs. p

ggplot(logistic_distn_inv_cdf, aes(p, logit_p)) +

# Make it a line plot

geom_line()

The inverse CDF is the “opposite” transformation to the CDF. If you flip the x and y axes on this plot, you get the same plot you saw in the previous exercise.

15.4.2.2 binomial family argument

binomial() is a function that returns a list of other functions that tell glm() how to perform calculations in the regression.

The two most interesting functions are linkinv and linkfun, which are used for transforming variables from the whole number line (minus infinity to infinity) to probabilities (zero to one) and back again. (Link function is a transformation of the response variable)

x <- seq(-10, 10, 0.2)

p <- seq(0.01, 0.99, 0.01)

# Look at the structure of binomial() function

str(binomial())## List of 13

## $ family : chr "binomial"

## $ link : chr "logit"

## $ linkfun :function (mu)

## $ linkinv :function (eta)

## $ variance :function (mu)

## $ dev.resids:function (y, mu, wt)

## $ aic :function (y, n, mu, wt, dev)

## $ mu.eta :function (eta)

## $ initialize: language { if (NCOL(y) == 1) { ...

## $ validmu :function (mu)

## $ valideta :function (eta)

## $ simulate :function (object, nsim)

## $ dispersion: num 1

## - attr(*, "class")= chr "family"Notice that it contains two elements that are functions, binomial()$linkinv, and binomial()$linkfun.

binomial()$linkinv = logistic distribution CDF, plogis()

# Call the link inverse on x

linkinv_x <- binomial()$linkinv(x)

# Check linkinv_x and plogis() of x give same results

all.equal(linkinv_x, plogis(x))## [1] TRUEbinomial()$linkfun = inverse CDF, qlogis()

# Call the link fun on p

linkfun_p <- binomial()$linkfun(p)

# Check linkfun_p and qlogis() of p give same results

all.equal(linkfun_p, qlogis(p))## [1] TRUEThese are used to translate between numbers and probabilities.

15.4.2.3 Logistic distribution parameters

The normal distribution has mean and standard deviation parameters that affect the CDF curve. The logistic distribution has location and scale parameters.

These two parameters allows logistic model prediction curves to have different positions or steepnesses.

location increases — logistic CDF curve moves rightwards

scale increases — the steepness of the slope deceases

15.4.3 Model performance

Likelihood

sum(y_pred * y_actual + (1 - y_pred) * (1 - y_actual))

When

y_actual = 1y_pred * 1 + (1 - y_pred) * (1 - 1) = y_pred

When

y_actual = 0y_pred * 0 + (1 - y_pred) * (1 - 0) = 1 - y_pred

Log-likelihood

Computing likelihood involves adding many very small numbers, leading to numerical error.

Log-likelihood is easier to compute.

log(y_pred) * y_actual + log(1 - y_pred) * (1 - y_actual)

Negative log-likelihood

Maximizing log-likelihood is the same as minimizing negative log-likelihood.

-sum(log_likelihoods)

15.4.3.1 Likelihood & log-likelihood

Logistic regression chooses the prediction line that gives you the maximum likelihood value. It also gives maximum log-likelihood.

15.4.3.2 Logistic regression algorithm

Rather than using sum of squares as the metric, we want to use likelihood. However, log-likelihood is more computationally stable, so we’ll use that instead.

Actually, there is one more change: since we want to maximize log-likelihood, but optim() defaults to finding minimum values, it is easier to calculate the negative log-likelihood.

Calculate the predicted y-values as the intercept plus the slope times the actual x-values, all transformed with the logistic distribution CDF.

x_actual <- churn$time_since_last_purchase

y_actual <- churn$has_churned

# Set the intercept to 1

intercept <- 1

# Set the slope to 0.5

slope <- 0.5

# Calculate the predicted y values

y_pred <- plogis(intercept + slope * x_actual)

# Calculate the log-likelihood for each term

log_likelihoods <- log(y_pred) * y_actual + log(1 - y_pred) * (1 - y_actual)

# Calculate minus the sum of the log-likelihoods for each term

-sum(log_likelihoods)## [1] 326Complete the function body.

calc_neg_log_likelihood <- function(coeffs) {

# Get the intercept coeff

intercept <- coeffs[1]

# Get the slope coeff

slope <- coeffs[2]

# Calculate the predicted y values

y_pred <- plogis(intercept + slope * x_actual)

# Calculate the log-likelihood for each term

log_likelihoods <- log(y_pred) * y_actual + log(1 - y_pred) * (1 - y_actual)

# Calculate minus the sum of the log-likelihoods for each term

-sum(log_likelihoods)

}Optimize the maximize log-likelihood metric.

# Optimize the metric

optim(

# Initially guess 0 intercept and 1 slope

par = c(intercept = 0, slope = 1),

# Use calc_neg_log_likelihood as the optimization fn

fn = calc_neg_log_likelihood

)## $par

## intercept slope

## -0.0348 0.2689

##

## $value

## [1] 273

##

## $counts

## function gradient

## 51 NA

##

## $convergence

## [1] 0

##

## $message

## NULL# Compare the coefficients to those calculated by glm()

glm(has_churned ~ time_since_last_purchase, data = churn, family = binomial)##

## Call: glm(formula = has_churned ~ time_since_last_purchase, family = binomial,

## data = churn)

##

## Coefficients:

## (Intercept) time_since_last_purchase

## -0.035 0.269

##

## Degrees of Freedom: 399 Total (i.e. Null); 398 Residual

## Null Deviance: 555

## Residual Deviance: 546 AIC: 550The maximize log-likelihood is 273.2002